$26M Capped ASX Stock Generating Millions in Revenue: US and Chinese Markets are Next

Published 14-JUN-2016 10:49 A.M.

|

19 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With a total global market of $90 billion, successful hair loss products can generate hundreds of millions of dollars in revenue.

However the current market leaders may soon be under pressure from one particular ASX listed life sciences company.

This company’s product looks like it could one day grow to become the dominant global market leader in hair loss.

The company literally ‘owns’ the latest clinically validated science in minimising hair loss, and has been growing its revenues by 100% year on year.

It’s on target to hit another significant revenue milestone this financial year, and this is based on sales in Japan and Australia alone.

In the coming months, this company is expanding its sales into the multi-billion dollar markets of the US and China – and it’s not impossible for revenue growth to reach the hundreds of millions over the coming years for this company.

This $26M capped stock is one of the very few ASX listed junior biotechs already generating millions of dollars in revenues – which is no small feat.

The product is based around inhibiting FGF-5, a protein that contributes to accelerated hair loss.

This company has created a range of natural products shown to inhibit the FGF-5 protein, thus reducing hair loss and increasing hair volume and growth.

With a monopoly on this hair loss prevention technology, this company is steadily stealing market share from incumbent market leaders.

This is a highly profitable enterprise, with margins exceeding 70%. In fact this company only looks at products that can produce at least a 70% gross margin – a wise business move.

We are looking out for major news flow in the coming weeks that confirms this company’s entry in US and Chinese markets, and from there we will be watching how this company’s revenue accelerates.

Remember, however, that this is still an early stage play and anything can happen, so apply caution to any investment decisions you make with regard to this stock.

There is more than just the hair loss side to this business though.

Further catalysts may also be evident in this company’s other business units, which look into diagnostics technology and novel treatments for fibrosis and cancer.

The company has also been generating millions in licensing and royalty revenues since 2010 from its diagnostics business, for minimal capital outlay.

NZ listed Pacific Edge uses our company’s patented technology for the early detection of bladder cancer. Pacific Edge recently signed a large US defence force contract, and this is expected to vastly increase our company’s royalty fees.

But that is not all to this $26M stock – there is also a blue sky, big picture, long game play.

It has an antibody portfolio that is targeting the multi-billion dollar markets of fibrosis and cancer and there is solid, pre-clinical evidence that the drug it is developing to combat these diseases may just work.

This ‘blue sky’ proposition is set to unfold over the coming months and beyond, as the company approaches the highly value accretive phases of clinical trials.

These trials will be conducted in a sector that has seen many billion dollar deals done between Big Pharma heavyweights and the small biotech companies like this one.

This company is clearly focusing on high value markets, it is already generating revenue and is capped at just $26M – at odds with its blistering financial performance, and high potential clinic ready drugs.

Are we at a value inflection point right now?

Introducing:

The gameplan

The most important thing to note about Cellmid (ASX:CDY) is that this isn’t an all-or-nothing play.

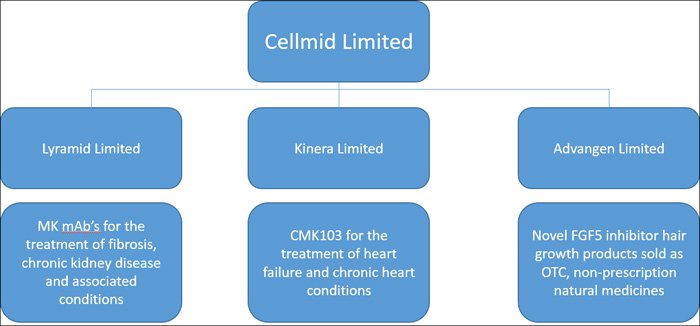

CDY is actually the sum of three very attractive, 100% owned subsidiaries, which when added together appear to belie its current $26 million market cap.

This company structure, amongst other advantages, chiefly allows venture capital, government, or private investment to invest in particular parts of the listed vehicle, depending on what piques their interest most. These investments into the wholly owned subsidiaries are also reducing risk and dilution for holders of the listed CDY shares.

This company could be thought of as a life sciences accelerator, and as stated earlier it only pursues high margin endeavours, that is, with margins over 70%.

Let’s find out more...

CDY’s subsidiaries in more detail

The three public unlisted companies that CDY own can be viewed in the diagram below.

They are: Lyramid Limited, Kinera Limited and Advangen Limited.

Lyramid is the business unit responsible for looking at a way of fighting midkine (MK), as it applies to chronic kidney disease and associated conditions. We will look at MK in further detail shortly.

Lyramid is directly responsible for developing the clinic ready drugs, CAB102 and CAB101, which CDY is hoping could one day attract a nine-figure deal. This could be some time away, but does present the blue sky opportunity in this stock.

Kinera has been set up to find a solution to the damage associated with heart attacks through its CMK103 treatment, which is for the treatment of heart failure and chronic heart conditions – again this is a multi-billion dollar sector that the company is looking to crack, however trials may be a little further away than those within the Lyramid subsidiary.

Advangen is the consumer health unit of CDY’s company, and is currently making money. Aside from the blue sky potential in Lyramid and Kinera, Advangen really demonstrates how undervalued this stock is right now.

Advangen is the CDY subsidiary that sells the novel FGF-5 inhibitor hair growth products we described above, and is expanding its sales into the very large US and Chinese markets over the coming months.

Advangen down the track will look at anti-aging and anti-oxidant products, once again expanding CDY’s presence into wider consumer health markets.

By operating the above units separately, it can seek investment in individual sections of the company, thereby ensuring an optimal value is derived for CDY shareholders.

Let’s look at Advangen in more detail...

Advangen – a ‘growing’ business for CDY

Many biotech plays rely solely on R&D funding, but CDY has a handy business unit already up and running.

CDY sells a product known as èvolis under its Advangen unit– which inhibits the human protein FGF-5.

It’s been proven that the suppression of FGF-5 can be effective against hair loss – in research going back a decade .

From the linked research:

“FGF-5 inhibitors with FGF-5-antagonizing activity may be effective against hair loss, as these inhibitors suppress the transition of hair follicles from the anagen to catagen phase caused by FGF-5.”

What does that mean?

Essentially, the Japanese authors of the study above conducted studies on mice and found that by inhibiting FGF-5 positive hair loss outcomes were achieved.

In 2015, CDY undertook a study in New York through AMA Laboratories which found that in a 32 patient study the use of its market-ready product twice a day showed an 80.2% hair loss reduction over 112 days.

Meanwhile, there was a 44.2% increase in hair follicle growth in the same period.

If we fast-forward through a decade of research and product development, CDY’s product is the only one on the market which inhibits FGF-5 – and it’s been clinically proven.

That’s not just marketing speak.

As we stated in the introduction, this product is already on the market and generating revenue. It is expected to net the company another significant revenue increase from the $1.8M last year, and this is a high margin product, in the order of over 70%.

The product is selling only in Australia and Japan now, and the next major catalysts for this part of the business will be the product’s entry into the large US and Chinese markets.

Remember, right now CDY has a market cap of approximately $26 million – roughly over 8 times its revenue that is growing 100% year on year, from just this one business.

That’s quite a disconnect.

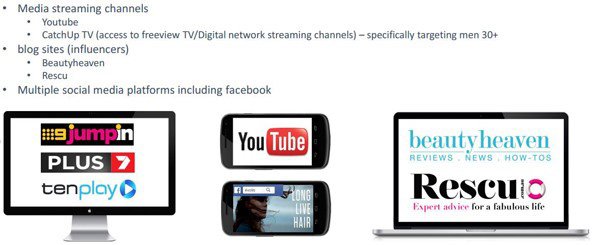

In the past two years the company has conducted a marketing blitz in Australia – you may have even seen some of the infomercials and advertisements yourself.

CDY has advertised on both TV and digital platforms, targeting men and women.

Along with the consumer push, CDY has pursued a large sales push with chemists and hair beauty outlets – and developed a wider product line to take up more shelf space.

In fact, CDY is targeting 2000 Australian pharmacies in the coming months. All in all, CDY is projecting its sales push to look something like this:

If all goes well, that’s ten-fold growth in revenue over two years.

We can’t wait to see what another two years of sales brings for the business...

What the sales push demonstrates, is that CDY is able to pull off a significant level of growth in predominantly the Japanese and Australian markets alone.

According to Euromonitor International research , the global hair care market was worth $90 billion in 2014.

Let’s assume CDY hit $4 million in revenue in 2016 from the hair business – this is only about a 0.000044% slice of the action, barely scratching the market.

Beyond this, CDY only really need capture a tiny fraction of the market (for example, 1-2%) to make a significant sum of money and keep its shareholders happy.

What’s more, CDY has forecast the market to grow by 20% year-on-year to 2018...

So, it’s a large, growing market and CDY only needs to capture a small piece of it to potentially become a large player.

With imminent expansion into the US and later in China, it’s certainly a strong chance to hit some much larger revenue numbers over the coming years.

Of course, future sales figures are never a guarantee, and company sales projections should not be the only thing you consider when making an investment in speculative biotech stocks. Always consider your own personal circumstances and seek professional advice.

Now let’s focus on CDY’s therapeutic products.

CDY’s “midkine” business

Literally hundreds of scientists around the world are gathering a compelling body of peer reviewed evidence that points to the presence of a certain protein in the body, midkine, as being a key indicator for a number of serious health problems – from cancer, to chronic kidney disease.

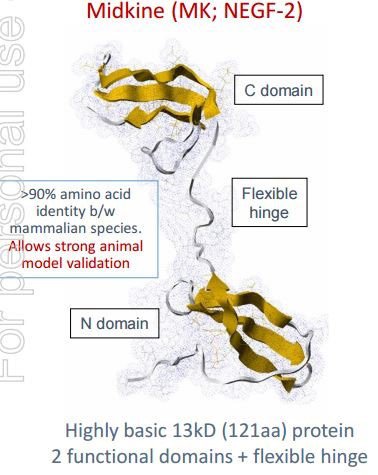

Midkine (or MK for short) is a protein that is highly expressed during embryonic development, and modulates many important biological interactions such as cell growth and migration.

When you extend that to think of how cancer grows, and how chronic heart disease and fibrosis develops, it could be that the understanding of MK related indicators may be key to effective treatment.

It is this understanding of how tumours grow and how to suppress this in patients that has scientists racing to a proof of concept deadline.

As fibrosis, the most significant consequence of diabetes, and cancer, represent some of the biggest pharmaceutical markets, CDY is focused on tackling them as a priority.

But, what exactly is MK?

At its most fundamental level, MK is a native protein which assists in tumour and inflammation progression.

In very simplistic terms, if the body is producing an oversupply of MK, it is a sure sign that something is seriously wrong; either there is chronic inflammation or cancer. When it is overproduced in cancer patients, it indicates worse outcome.

The main game for CDY is the development of drugs targeting MK with the premise of reducing or inhibiting the cell growth promoted by MK, and thus inhibiting the development of tumours and inflammation.

CDY owns almost all of the patents on midkine globally, approximately 95% of them.

This is approximately 79 patents and applications for MK-related treatments, within 20 patent families.

The value of these patents should not be overlooked when evaluating this stock.

CDY also runs a biennial Midkine Symposium where scientists from around the world present their research on this technology. The intellectual property so generated is normally owned by CDY. It’s like having hundreds of scientists working for free, or for the opportunity to access some of the scientific assets of CDY.

Given CDY is a market-leader in MK, where MK is becoming a very important disease target, it is clear that scientists are gravitating to the company to be part of this new and exciting technology.

CDY is thus able to leverage the intellectual capital of the world’s sharpest minds in the space for free.

CDY has been hard at work patenting several MK-based treatments for cancer and for the treatment of inflammatory mediated diseases such as chronic kidney disease.

CDY’s MK treatments are designed to inhibit (i.e. prevent or slow down) the migration of ‘inflammatory leukocytes’, responsible for much of the inflammation.

Because of its role in the exacerbation of both cancerous tumours and inflammatory diseases, MK is also being thought of as a useful bio-marker in detecting the occurrence of tumours and inflammation.

CDY has been making progress on patenting several MK-related treatments.

It is also making good progress on clinical trials of two key treatments: CAB102 and CAB101, which we will delve into in the next sections.

CDY’s subsidiary Lyramid’s anti-body assets – clinical trial ready

We touched on it earlier, but it’s worth reiterating – CDY owns the most comprehensive IP portfolio around the MK drug target for the diagnosis and treatment of cancer, inflammatory and fibrotic conditions.

This company has already executed on early licenses and delivered revenue but the royalties are just beginning to come in now, as these products are beginning to enter the market.

But for now, let’s take a look in detail at what CDY has at pre-clinical trial stage.

CAB 102

This program is being designed to stop the growth and development of solid tumours by targeting MK.

As part of pre-clinical work CDY undertook, the company tested an anti-MK molecule under development via animal trials. The purpose of the test was to inspect the molecule and check for side effects or toxicity issues CDY should be aware of before moving forward.

Animals with a similar match to humans were selected. These animals were selected because the MK in their system is identical to CAB102-binding properties in humans – not a perfect analogue but close.

The important news to come from these tests was the molecule was well tolerated in animals – with no dose limiting toxicities or organ damage evident in the animals after treatment.

Even at a dose of 10 mg/kg – up to 10 times higher than the forecast dose level for humans – there were no observed side effects.

As far as a pre-clinical study goes, it was a success and should help regulators when deciding whether or not to approve any Phase I trial the company puts forward.

CAB101

CAB101 is aimed at kidney injury and inflammatory diseases, quite often expressed in kidney disease as a function of chronic kidney disease.

CAB101 is still in the pre-clinical stage but so far is looking positive.

In vivo testing in various animal profiles models of inflammation and autoimmunity, show that the disease can reduce inflammatory cell infiltration and increase T lymphocyte cell numbers.

Remember, MK treatments are about assisting the inflammation caused by infiltration of inflammatory cells that cause tissue damage and fibrosis – so the reduction of cell inflammation is a good sign.

Testing, testing, testing

We mentioned earlier that CDY is running a diagnostics business – again leveraging off its ownership of such a commanding portfolio of midkine related IP.

MK is emerging as a reliable biomarker for cancerous tumours and kidney inflammation, including re-occurrence of these problems.

There’s a whole market out there in consumer diagnostic kits dedicated to finding out whether cancer has returned and they’re increasingly being used as a potential way to avoid visits to the oncologists’ office for regular testing – something which frees up the oncologist for more vital matters and avoids the fees for the visit.

These diagnostic kits are increasingly being sold by hospitals to patients.

CDY has leveraged its IP (and importantly its patents) in using MK as a marker for cancer and licenced the IP to various companies developing these kits.

It has three arrangements on the books – two of which are generating ongoing royalties for CDY.

The most advanced of these is an arrangement with NZ-listed Pacific Edge .

CDY has received more than $1.5 million in license fees and royalties to date for its midkine IP, which is helping Pacific Edge detect bladder cancer through its flagship product CxBladder.

The product has been launched in the major US market – with the promise of more business and royalties to come.

Incidentally, CxBladder and the commercial promise it provides has rocketed Pacific Edge (NZX:PEB) to a market valuation of more than $200 million NZD .

Pacific Edge has confirmed a contract with the US Army who want to roll this product out across the whole organisation, and that is going to mean much bigger revenues for Pacific Edge, flowing through to much bigger revenues for CDY.

CDY’s intellectual property is playing a massive role here, licensed for the CxBladder product to Pacific Edge, and yet CDY’s cap remains around $26 million .

Again, there’s a large disconnect which suggests that the Australian market is yet to pick up on the potential of CxBladder and Pacific Edge – and has therefore severely underestimated the amount of royalties which are starting to flow to CDY.

Midkine and heart failure – a closer look at CDY’s Kinera subsidiary

CDY set up its Kinera subsidiary to explore MK’s relation to heart failure, and within that subsidiary, is developing the drug CMK103 for the treatment of heart attack and chronic heart conditions.

This one is a little further away from clinical trials, but it is something that long term investors in CDY certainly keep their eye on.

Let’s understand a little more about CMK103.

CMK103

CMK103 is a drug targeted at cardiac ischemia (commonly known as a heart attack).

When a person suffers a heart attack, there is suffering in the event and the aftermath. No matter how good the treatment is to stop the cardiac event – there’s always going to be some lasting damage to the heart muscles.

This includes apoptotic death in the occluded myocardiocytes – damage or death to the cells which make up the heart muscles.

CDY already tested this drug in large animals, pigs, whose heart is very similar to humans. The drug reduced mortality three fold, and significantly reduced infarct size. There is currently NO DRUG on the market that can do that.

If CDY is successful in proving up its treatment it will be able to prevent much of the lasting or permanent damage associated with the event and keep people from having another heart attack.

Needless to say, this could improve the quality of life for millions of people.

Remember, however, that this is early stage and there is much research still to be done, so seek professional advice when considering his stock for your portfolio.

With all that in mind, who is running the show at CDY?

CDY’s CEO and managing director – Maria Halasz

A biotech company is only as good as its brain power, and luckily for CDY it has a mix of biotech prowess and business nous, chiefly driven by its CEO, Maria Halasz.

Maria Halasz has 22 years’ experience in the biotech game and was the driving force behind the company’s acquisition of its MK and Advangen business – having been the MD and CEO of the business since 2007.

Ms Halasz has been a public CEO for quite a while and has pulled off deals in the US, China, Europe, Japan, and the UK – which means no matter where the interest comes from she’s quite comfortable doing a deal.

Interestingly, Ms Halasz has also dipped her toe in the VC world as a venture partner of the ‘Emerging Technology Fund’ at VC company Allen and Buckeridge, and was director of corporate finance at BBY at the time it had a strong life sciences franchise.

She knows exactly what a VC or the capital market investor may be looking for in the biotech sector, and has the remit to grow the company to a point where it may look too good to ignore.

And that will hold CDY in good stead over the coming months.

So, how to value CDY?

Trying to value a biotech company is never easy.

Do you make your valuation by the raw amount spent on medical treatment around the world for a particular disease?

That would be disingenuous, as no single company could capture the entire market.

Instead, biotech companies are much like tech companies when trying to ascribe value to them.

In the past, biotech companies were often picked off at the Phase II, and III clinical trial stages of drug development by larger biotechs and VCs looking for the next ground breaking medical discovery.

In the last few years this has changed substantially – and we have been seeing billion dollar deals with ‘pre-clinical’ stage companies.

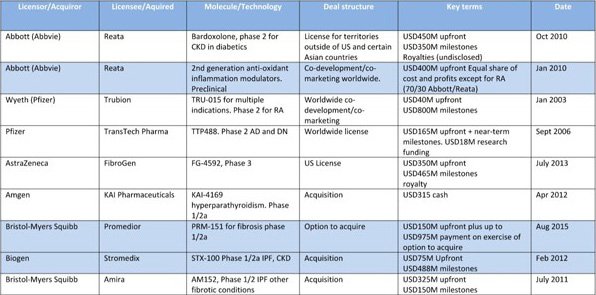

Below is a list of deals made in the fibrosis space, in which CDY’s subsidiary Lyramid is a participant, which may provide an example for what investors of CDY could expect if everything goes to plan.

As you can see, these are all nine-figure deals and higher.

This is the kind of game CDY is playing, and big pharma may start to really look a little closer at the company as it moves to Phase I trials.

But CDY is not an all or nothing play. Its differentiation is in its business structure meaning CDY is giving itself multiple bites of the “value add” cherry.

The above deals in the table only cover fibrotic related deals, meaning the value CDY may obtain for its Kinera of Advangen businesses is not even entered into the equation.

Aside from the blue sky treatments the company is researching, it has a strong revenue generating hair loss business, that appears only set to expand quickly as products hit the shelves in the USA and China.

Not to mention the diagnostics business that is also pulling in millions in revenue, for almost zero costs to the company.

As a takeover target and as an underlying business CDY has put together its game plan nicely.

However you value CDY, it’s clear that a $26 million market cap could be seriously missing the mark...

The Final Word

The business structure CDY has put together is important to its future growth.

It appears that CDY are on the right track with an underlying, high growth, high margin revenue stream.

Through its consumer-facing health care business and its licensed diagnostics assets, it’s in the process of building a very solid foundation.

Whilst CDY continues to report strong revenues from its health and life sciences businesses, it is building its potentially high-impact therapeutic offering as it prepares to move through the testing phases.

It’s often at this point where biotech plays are able to attract a couple significant offers as the Big Pharma groups and VC investors sort through the data...

By separating out its business units, CDY has made sure that this isn’t an all-or-nothing play, with the potential for offers for specific parts of the business.

It is a balanced portfolio of life sciences assets with current revenue and lower risk, along with blue sky potential that is in highly credible therapeutic areas with outstanding science supported by hundreds of scientists around the world.

With a market cap of just under $26 million, it appears the market has some catching up to do in the space and given the near term catalysts at hand, it may not stay this way for long.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.