MMJ Set to Boost Medical Cannabis Production Capacity by 1000%?

Published 01-APR-2016 10:49 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

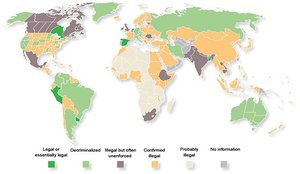

The market for medical cannabis is gradually moving out of the wilderness and onto government radars.

The once forgotten medicine is currently being re-evaluated and reclassified in the US, Australia and Europe as its positive effect on a range of ailments is finally being rediscovered and decriminalised by governments across the globe.

This clamor can be heard more so in some countries than others – and MMJ Phytotech (ASX:MMJ), given its global footprint across Canada, Israel, and increasingly, Australia is well positioned to benefit.

In Canada, for instance, medical cannabis has been legal since 2001 and further legislation will see it even more readily available.

This is good news for MMJ and its growing facilities in that North American nation, which are on the verge of full production.

MMJ has two Canadian growing facilities, Duncan and Lucky Lake which it intends to combine to expand its total production by 1100%.

With over A$5MN in funding recently secured , MMJ hopes its Lucky Lake facility – once licensed – will do exactly what it says on the tin, and produce over 12,000kg of high grade medical cannabis that can be processed, refined and sold on for anywhere between $10,000-$100,000 per kg depending on the grade.

With the high-margin premium element of its business nicely in the pipeline for harvesting down the track, MMJ is also monetising a high grade CBD product in capsule form which it already sells via a European subsidiary called Satipharm based in Switzerland.

Phase 1 clinical trials are complete with Phase 2 now on the horizon and scheduled to be completed by the end of this year. MMJ’s “formulations are the same or even higher performance level compared to market leader GW Pharmaceutical’s product”.

GW Pharmaceuticals just happens to be a £1.12BN (A$2.1BN) giant that’s currently the only company to have its medical cannabis product approved by the US Food & Drug Administration (FDA).

With its product standing shoulder-to-shoulder with the industry’s best, the A$39MN-capped MMJ is gradually assembling all the necessary pieces to solve the medical cannabis puzzle and crystallise its ambitious ‘Farm-to-Pharma’ strategy.

Remember however this is still an early stage play and any investment decision should be based on a range of factors – not just what you read here.

If successful, MMJ will establish vertically integrated operations with a global presence thereby enabling this budding grower to produce pharmaceutical-grade products that doctors and physicians can’t wait to get their hands on.

Checking in on:

As readers of The Next Biotech will know, we’ve covered MMJ PhytoTech (ASX:MMJ) in detail over the past year as it went through its original merger to create a fully integrated parent company listed on the ASX. Our previous articles can be accessed here:

MMJ’s Medical Cannabis Pill Performs Better than A$1.2BN Capped Competitor

Is a Cannabis Cultivation License Now Just Days Away for MMJ?

Medical Cannabis First Mover: MMJ to Accelerate Australian Roll Out

Game Changer for MMJ: First CBD Pill Sales Confirmed

We’re back to update you on this rapidly developing story largely tied to government civil servants and policymakers, who have twice now given favourable approvals to two of MMJ’s growing facilities, in the lead up to ‘Licensed Producer’ status.

MMJ’s Duncan Facility has been covered in length in the media , here’s a snapshot...

So let’s now focus on Lucky Lake.

MMJ’s Lucky Lake facility will add a further 12,000kg to MMJ’s total production

To compete in larger oceans, it helps to have a bigger boat.

MMJ’s Lucky Lake facility has just progressed to the next stage of the license approval process in Canada, and could potentially commence growing operations at the end of this year.

The aim is to integrate Lucky Lake with Duncan to expand its production exponentially.

Once online, Lucky Lake will boost MMJ’s existing capacity by 12,000kg per year (1100% from the current 1000kg) and position this ASX-listed grower as one of the largest licensed producers in Canada.

The timing is synchronistic because by the time government officials have worked out how they want to deal with cannabis, MMJ should have around 13,000kg of annual production ready for sale in either North America, Australia or Europe – all burgeoning markets tipped for high rates of growth.

Here are MMJ’s Canadian operations mapped out:

The two growing facilities in MMJ’s possession are state-of-the-art and able to produce high grade cannabis which can also be processed, stored and refined to achieve higher grades that eventually lead to higher sale prices.

Check out the wares at the Duncan Facility:

This type of facility will allow MMJ to produce the very best possible product.

Bear in mind that the Lucky Lake facility is over 10 times larger than Duncan and has the potential to really expand MMJ’s medical cannabis ambitions.

Lucky Lake is heading towards approval and is now awaiting proposed health, safety and security measures.

With the impending integration with Duncan on the back of the Allard ruling, MMJ could position itself as one of the largest producers in Canada.

The Allard decision

Not only has the Canadian government publicly admitted to harbouring plans for full blown legalisation, but it is also facing the prospect of having to rework its entire MMPR medical cannabis licensing scheme following a recent court judgement ruling the scheme was effectively unconstitutional.

The court decision in the case of Allard and Her Majesty the Queen , was initially seen as a problem because the entire licensing policy would have to be reworked therefore negatively affecting existing licensees.

But as Benjamin Franklin once remarked; every problem is actually an opportunity in disguise.

Far from being a negative, the Allard decision has all the hallmarks of being a timely opportunity because it formally recognises people’s rights to use cannabis as a medicine and more.

The Allard decision sets the stage for the entire Canadian cannabis industry to be catapulted into a much larger and deeper commercial ocean with fewer restrictions including allowing recreational cannabis use.

The Canadian government is quietly conjuring up plans to implement a full-blown legalisation policy to include both medical and recreational uses.

If this eventuates into reality, it would be a boon for MMJ rather than a problem because MMJ is on course to find salvation in economies of scale.

Cannabis could become a priceless medicine worth $5BN annually.

Globally, some estimates are valuing medical cannabis at around US$40BN per year.

Taking advantage of this tectonic change at this early stage is MMJ who is at the front of the queue to start commercialising medical cannabis as and when government officials give the green light.

Of course timing is everything and MMJ is not quite at commercialisation stage yet, so apply caution to your investment decision.

The Best of the Rest

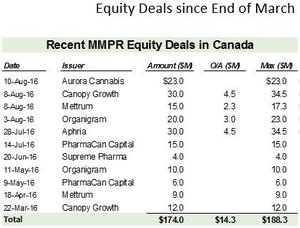

As MMJ takes its first steps in the world of commercial medical cannabis, what are some of the other players up to?

This question is rather important because when it comes to cannabis, it all comes to down to how potent and effective your product is.

While MMJ progresses its growing operations under Canadian subsidiary United Greeneries, its Israel-based unit Phytotech Therapeutics, is progressing with clinical trials of MMJ’s CBD-based oral capsule, designed for treating multiple sclerosis.

As part of a regulatory filing with the ASX, MMJ reported that its trials “indicate that MMJ’s formulations are the same or even higher performance level when compared to GW Pharmaceutical’s product”.

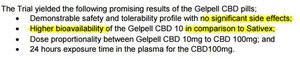

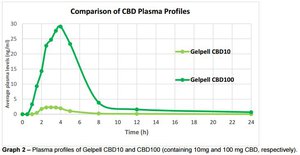

As part of the Phase 1 trial assessing the safety and performance of MMJ’s Gelpell CBD pills, MMJ’s oral capsules were administered to 15 volunteers in comparison to Sativex, the leading oromucosal medicinal cannabis spray from GW Pharmaceuticals.

A comparison of plasma concentration over time between MMJ’s CBD/THC capsule and GW’s oromucosal spray indicates that MMJ’s capsules have a quicker uptake time and longer-lasting effects within the patient.

Here is a summary of the trial’s conclusions with a handy comparison chart further down:

Phase 2 trials will commence later this year, assessing the efficacy of oral capsules in treating pain and spasticity amongst multiple sclerosis sufferers, with results expected in 2017.

Could this be a catalyst for MMJ down the track?

If we look around for some other companies involved in clinical trials, GW Pharmaceuticals pops up again, and for all the right reasons.

Look what happened to GW’s share price upon receiving heart-warming clinical trial results in mid-March 2016:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The Phase 3 trial proved that GW’s Epidiolex significantly reduces seizures in patients with Dravet syndrome – a type of epilepsy with few available treatment methods. Furthermore, there are no licensed treatments for Dravet syndrome whatsoever in the US.

GW’s trial results were immediately seized upon by speculative investors which is an early sign that medical cannabis treatments are starting to back up their medicinal potential with commercial performance.

Paddock to Plate

With MMJ adding all the necessary puzzle pieces to become a stalwart player in medical cannabis, it’s ‘farm-to-pharma’ strategy is taking shape.

The strategy means MMJ can develop and retain key IP patents for bespoke plant strains and delivery technologies...

...and bring these to market without involving third parties via in-house cultivation and refining facilities.

If MMJ captures the entire paddock-to-plate chain, the commercial margins could be substantial given that high grade medical cannabis can fetch $10,000-$100,000 per kg depending on the strain, potency and overall quality of the product.

These numbers are speculative only and are meant as a guide, no investment decision should be made based on these figures alone.

Research from Sydney University indicates Australian market in isolation will be worth $150MN+ and already requiring 8000kg per year

The study has been published at a critical time with the Australian government currently at a crossroads as to how it will legislate for its operation and wider societal impacts. Cultivation of medical cannabis is on the verge of being legalised following recent law changes at the Federal level and supportive commentary from senior politicians including Prime Minister Malcolm Turnbull.

What does this mean for MMJ?

One of its key priorities is to leverage its offshore operations in Australia by importing CBD capsules from Switzerland.

These capsules would be similar to those being sold in Europe through MMJ’s Satipharm subsidiary (see below).

The Australian market could open up a range of commercial possibilities for MMJ, particularly as it investigates partnerships with farmers, horticulturalists and Australian growing facilities.

Suffice to say that MMJ management is buoyed by current activities.

The farm to pharma play

Here’s a quick update of MMJ’s corporate structure:

Each subsidiary takes care of a particular part of the overall strategy: United Greeneries for bulk high grade growing, Satipharm for immediate CBD sales and Phytotech Therapeutics for future IP research, development and clinical trials.

Farm to pharma on paper and in deed, but how does it relate to future opportunities?

Putting the feelers out for future catalysts

The staggered nature of international cannabis regulation is presenting both problems and opportunities.

It’s problematic for public officials who look at other countries and try to replicate sound policy domestically. It’s also problematic for patients who are missing out on effective treatments simply because of regulatory lag.

The opportunities that now present themselves in medical cannabis are huge.

Both the US and Canadian markets have taken a strong lead on the global stage and are already on course to create a combined market of over US$100BN over the coming years.

Gold rush or green rush?

Take a look at what cannabis industry expert Ackrell Capital said in its US Cannabis Investment Report 2016 :

“The accelerating momentum toward cannabis legalization and the growth of this newly created market will result in the ‘green gold rush’ of our generation. A modern understanding of cannabis and a thorough analysis of both the opportunities and risks are paramount to evaluating the cannabis industry, which has the potential to reach more than 50 million consumers [US only]”.

And here’s its cannabis market projections for the coming decade:

MMJ has not missed a beat by setting up a global operation that selects the best strains, grows them en masse and is therefore able to produce premium fit for medical produce that benefits from economies of scale.

Phase 2 trials of its medical products will start later this year while its growing facilities are being kitted out to produce 13,000kg each year

The next checkpoint for MMJ is an AGM scheduled for 22 April when its recent $5MN institutional Placement will be ratified and formally approved.

This will give the green light for Phase 2 trials to commence in Israel. Around the same time, MMJ plans to start importing its CBD Gelpell capsules into Australia for public sale .

With so much commotion to accelerate legalisation from around 1 million Australian cannabis users, many of whom suffer from a gamut of ailments, this move could already net MMJ some healthy revenues later this year.

For MMJ, the future is bright and of a rather green variety.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.