DXB to run a Phase III COVID-19 Study in Australia

Regular Finfeed readers should be familiar by now with Dimerix (ASX:DXB) - the first investment in our small cap ASX listed biotech portfolio.

DXB has developed a treatment for inflammatory diseases, such as kidney and respiratory diseases.

We invested in DXB back in August when it raised $20M at 20c to follow the progress of the fully funded Phase III clinical trials for FSGS (which is a rare but debilitating kidney disease). There are no currently approved therapies, and it's a $1B plus addressable market.

We like to call this our “main bet” and is our key reason for investing in DXB.

However, DXB also has two COVID-19 treatment studies that are progressing in Phase III clinical trials in the near term which we like to call our "DXB side bets".

COVID-19 is a global pandemic and there is a pressing need to treat COVID patients, we are hoping that a successful outcome in either of these studies will be positively received by the market.

If successful DXB's COVID-19 treatment will be delivered orally via a pill that the patient can swallow, which is familiar and preferable over injections, intubation or other intrusive administration methods.

DXB is moving fast with these trials, and today announced that this COVID-19 Phase III Study will expand to Australia.

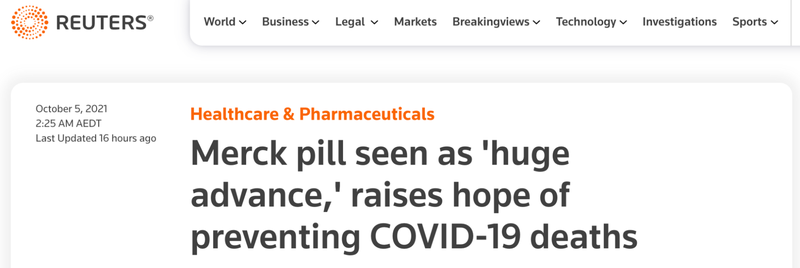

The prize is big, with US based pharmaceutical company Merck and Co. (NYSE:MRK, $200B Market Cap) the first to successfully create an effective oral treatment for COVID-19, securing over $1.2B from the US Government. Interestingly, there are a lot of similarities in DXB’s trial design to Merck - but the true value will be in the results.

With approval for the study granted in India, 600 patients will be recruited across both Australia and India, and undergo DXB’s COVID-19 treatment to identify whether it can help manage the effects COVID-19.

Running the trials now in Australia, a tier 1 jurisdiction for medical trials, provides further legitimacy and scope to the Study, complementing the India trials.

COVID-19 is obviously a very main stream topic, especially in Australia as the country looks to open its international borders for the first time in over a year.

So far, the global health community has used vaccines to reduce the effects of the disease.

However, a significant portion of the population will remain susceptible to COVID-19 because they are not vaccinated, or the vaccine’s potency has worn off.

A safe, affordable, and effective oral COVID-19 treatment would be a huge advance in the fight against COVID - as it would add another tool for the governments to relieve the pressure on the health system which is anticipated to strain as Australia opens up.

Last Monday big pharma company Merck advanced emergency use approvals for the first ever oral treatment of COVID-19, securing over $1.2B from the US Government.

Even once COVID-19 reaches the endemic stage (where it is not as damaging like the flu), it is anticipated that the market for COVID-19 treatment will still be around $6B.

Just last week, the Australian prime minister put in an order for 300,000 units of Merck’s oral Covid-19 treatment, and we think that many more countries will follow.

Like Merck, if DXB can prove that their treatment is safe and effective at treating COVID-19 in a Phase III clinical setting, and fast track approvals for its treatment, then DXB will be in a position to partner with a big pharma company and commercialise its product.

We think this would be a huge win for DXB, and in our opinion the company’s market cap would likely soar - but let’s see what kind of results the studies can deliver first (we outline some other risks later in the note).

What we want to see next from DXB is ethics approval for their treatment in Australia and a recruitment update about the clinical trials in India. These are key stepping stones early in a Phase III trial to gather the data necessary to identify if the DXB treatment is safe and effective, specifically:

- DXB will be seeking ethics approval for the trial in Australia. We don’t anticipate any problems and we anticipate this will take up to 6 weeks.

- First patient dosed in India, we are expecting this any day now

- The safety hurdle met for the first 80 patients accomplished

Now with $27.5M in the bank after this month’s Share Purchase Plan closed heavily oversubscribed, we think that $88M capped DXB is in a strong position to conduct these COVID-19 clinical trials on home soil and provide extra hope for Australians as we emerge from the pandemic.

To highlight just how big this opportunity is for DXB, big pharma company Merck’s company value increased $15B on the news of successful Phase III COVID-19 trials - it was already an $185BN company and now is capped at $200BN...

According to Forbes, Merck is selling the drug for roughly $700 per patient, and they plan to provide treatments for 10 million patients by the end of the year. This equates to a massive $7B in revenues for the company by Christmas.

The US government has already agreed to a $1.2B purchase of the drug, and we expect many more countries to follow. In fact, just last week the Australian government agreed to purchase 300,000 doses of the antiviral pill.

It is early days of course, but if DXB’s COVID-19 trial is as successful as we hope, we think that it could provide a similarly strong commercial outcome for the company with a material share price re-rating to follow.

DXB is a small cap stock currently valued at $88M - so whilst an investment in DXB is risky as it doesn't have any revenue generating products to fall back on, DXB does offer a lot more leverage to success than the already big Merck.

A Quick Science Lesson

Unless you have been living under a rock, then you would be familiar with the viral disease that has uprooted our lives for the past two years - COVID-19.

But how does the virus work exactly? Here is a quick science lesson...

When a person breathes in the SARS-CoV-2 virus, the virus infects the lung that absorbs oxygen called the air sacs. It is here that the virus replicates itself, infecting more and more cells within the lungs.

When this happens, your body has what is called a natural inflammatory (defense) response, causing the air sacs in the lungs to stiffen and fill with fluid.

Inflammation is natural, and helps our bodies fight infection. But in some people with COVID-19 it seems to go into overdrive, blocking the airflow to the lungs and oxygen to the bloodstream, making someone very sick.

Here is an excellent explainer video:

Alright, so how does DXB’s drug help?

DXB’s drug DMX-200 is an “anti-inflammatory”, which means that when the human body goes into overdrive fighting the infection, DMX-200 will (theoretically) make it more manageable for the body to recover.

This is quite a different to the solution announced by Merck.

Merck’s drug is an “antiviral” drug, meaning that it will attack the virus directly, confusing it to prevent it from replicating and spreading.

Because of the way that the Merck's drug works, the person will need to take the pill at the early stages of infection to get maximum effectiveness.

Because of the asymptomatic nature of the disease (meaning that it is undetectable for a few days), the patients MAY only take the drug when it is too late - the virus has already made itself at home.

There are also some underlying safety questions around the drug that have divided the scientific community.

Remember on the other hand, DXB’s proposed treatment is anti-inflammatory, meaning that it can still provide support at the later stages of the development.

DMX-200 solution has a very strong safety profile and potentially a better long term solution for COVID-19 going forward.

Where Merck’s solution is more advanced is that it has been proven to work in a clinical setting. That’s why the market reacted so positively to the Merck news.

DXB is yet to take this step - and that’s where the DXB’s current COVID-19 study comes in - it's called CLARITY 2.0.

REMINDER: What is the CLARITY 2.0 Study?

The CLARITY 2.0 Study will evaluate whether DXB’s drug DMX-200 will be able to treat patients diagnosed with COVID-19 who are intended for hospital admission.

In late 2020, DXB entered into an agreement with the NHMRC Clinical Trials Centre to undertake the study. Ethics approval for the trial was received in March, and just two weeks ago, the main drug regulator in India recommended the Phase III clinical trial for approval.

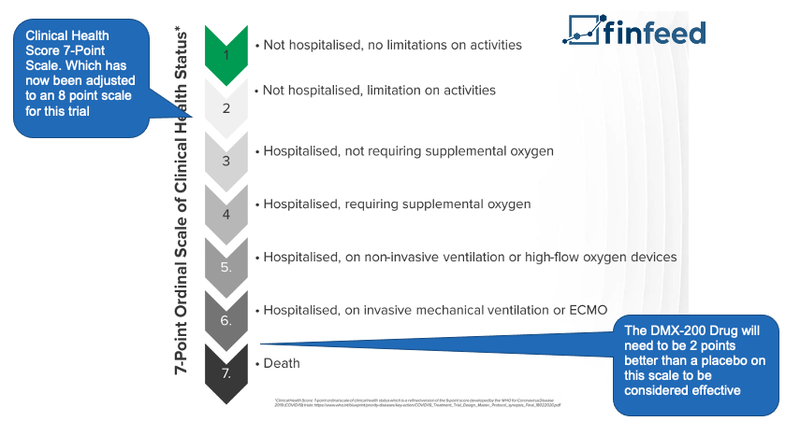

To evaluate the success, DXB’s drug will be measured on a 8 point scale which is set out by the World Health Organisation, and benchmarked against the effects of the placebo in 600 COVID-19 patients in India and Australia.

DXB is looking for a statistically significant result between DMX-200 and the placebo. The primary endpoint for DXB is that the DMX-200 drug needs to be 2 points higher than the placebo on the scale.

Here is an example of the seven point scale, which has been updated to 8 points for this particular trial:

What we like about DXB’s study design is that it is very similar to the design of the Phase III clinical trial that Merck undertook.

Like the Merck clinical trial, DXB’s Study:

- Follows the Clinical Health Scoring system set out by the World Health Organisation

- Is roughly the same size of patients (600 for DMX and 770 for Merck)

- The treatment for both cases is similar, an oral pill taken twice a day

- Like Merck, DXB will seek emergency use approval for the drug

What’s Next for DXB’s COVID-19 Studies?

In the lead up to Christmas we expect a raft of newsflow for DXB relating to the COVID-19 studies:

- DXB will be seeking ethics approval for the trial in Australia. We don’t anticipate any problems and we anticipate this will take up to 6 weeks.

- First patient dosed in India, we are expecting this any day now

- The safety hurdle met for the first 80 patients accomplished

Early in 2022 we should expect:

- Initial trial results for the study

- Whether the results are significant enough for DXB to seek emergency approval

If DXB reaches the stage where it can apply for accelerated emergency approvals, we expect DXB to look to partner with a big pharma company for distribution/sales.

This will be a major milestone for the company but there is still a lot of work to be done to get there.

What are the risks?

Small cap biotech stocks are high risk / high reward investments - only invest what you can afford to lose. Like all small biotechs, a number of things can go wrong - in the case of DXB, here are some specific risks we can see:

Primary endpoint not met

In terms of the treatment, DMX-200 is a drug that has been adapted to COVID-19 from an existing anti-inflammatory treatment for kidney disease. Other companies that have similarly adapted anti inflammatory treatment for COVID-19 have found it difficult, with Mesoblast abandoning research into their COVID-19 treatment when it didn’t reduce mortality for those aged 65 or higher.

The biggest risk for DXB in this scenario is that the trial results don’t indicate the DXB’s drug is effective at managing people with COVID-19.

If this is the case, it will be unfortunate for investors, but it will not affect the outcomes of our main bet, the FSGS trials.

Safety issues / ethics approval rejected

We don’t see either of these risks being an issue given the strong safety profile of DMX-200 and that ethics approval for this exact study has been granted in India.

Patient recruitment delays

As Australia opens up, unfortunately we do expect more people to get COVID-19. Whilst anyone getting sick is always unfortunate, on the flipside it does mean that there will be more available patients for the study and ultimately finding a treatment for potentially millions of people. So in terms of patient recruitment for DXB - we don’t see this as a big risk.

The race to commercialisation

There are a lot of horses in the race for a COVID-19 treatment, with Japanese drug maker Shiongi showing promising signs from their trials and Pfizer Inc and Roche Holland both with candidates in the works.

The prize is big, and that’s why there are a lot of companies chasing it.

Therefore, with alternative solutions emerging, it will be important that DXB’s treatment not only works, but works better than competing drugs.

DXB in a strong cash position

A quick note on the Share Purchase Plan (SPP) that closed two weeks ago - this followed a $20M placement to sophisticated and institutional investors.

DXB had a target to raise $2M in the SPP, but received applications for multiple times more.

As a result, DXB accepted $4M while still scaling-back applications. Under the SPP, approximately 20 million shares were issued at 20¢ each, together with 10 million attaching unlisted options.

As long term investors we are pleased that DXB has now raised a total of $24M (with $27.5M in the bank), putting the company in an excellent position to progress its three Phase III clinical trials and hopefully build some serious value.

The company also held its AGM two weeks ago. If you missed it, a transcript of the CEO’s address to shareholders (definitely worth a read!), as are her presentation slides.

COVID-19 Treatment (Side Bet 1)

The CLARITY 2.0 Study will evaluate whether DXB’s drug DMX-200 will be able to treat patients diagnosed with COVID-19 who are intended for hospital admission.

✅ Study Announced

✅ Ethics Approval

🔄 Regulatory approval by DCGI

🔄 Patient Recruitment Update 1

✅ [UPA] CLARITY 2.0 Study Announced in Australia

🔄 [NEW] Ethics Approval Australia

🔲 Safety Threshold Met (80 Patients)

🔲 Patient Recruitment Update 2

🔲 Patient Recruitment Update 3

🔲 CLARITY Phase III Study Complete

🔲 Primary Endpoint Reporting

🔲 Emergency use granted

🔲 Drug Commercialised

🔲 New Milestones Added

Investment Milestones for DXB

✅ Initial Investment: @20c

🔲 Increase Investment

🔲 Increase Investment

🔲 Price increases 500% from initial entry

🔲 Price increases 1000% from initial entry

🔲 Price increases 2000% from initial entry

🔲 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Profit

🔲 Hold remaining Position for next 2+ years

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.