Garnet Guru Joins $6M mineral sands microcap HVY

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,750,000 HVY shares at the time of publishing this article. The Company has been engaged by HVY to share our commentary on the progress of our Investment in HVY over time.

Our minerals sands Investment, Heavy Minerals (ASX:HVY) is putting the pieces together to build a globally significant garnet mine in WA by 2026.

Garnet is an important industrial material, specifically used in abrasive sand-blasting to treat and prevent rust on ship hulls, bridges and other large metal structures.

It is also used in “abrasive water-jet cutting” of metals, glass and other materials in the automotive, aerospace and electronics industries.

Yesterday, HVY announced the appointment of experienced garnet expert Aaron Williams to the board.

Aaron previously held the COO role at the world’s largest garnet producer GMA Garnet Group - which co-incidentally has a producing garnet project right next to HVY.

This is in addition to decades of experience in other executive roles at garnet related companies, including co-founding an abrasive blasting equipment company in Malaysia.

So Aaron brings some pretty unique experience to HVY, given he has mined garnet, and been on the downstream side of the market.

HVY is a $6M capped micro cap stock, at the development stage of its garnet mining project.

A scoping study based on HVY’s resource had an NPV of $253M, on a CAPEX of $110M (prior to the most recent JORC resource upgrade).

HVY’s scoping study numbers were enough to attract a letter of support from a Dutch sovereign wealth fund for project funding.

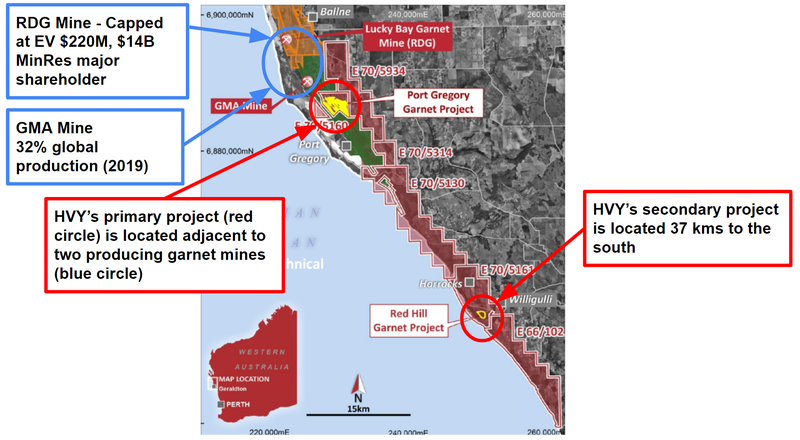

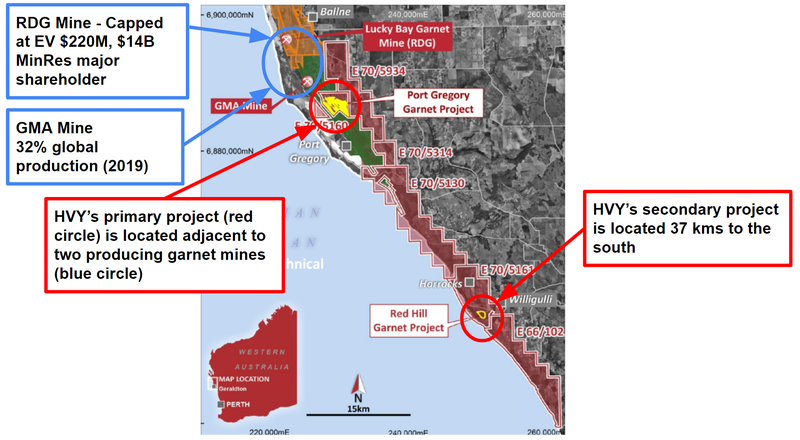

Below is where HVY sits next to its much bigger neighbours - we Invested to see HVY go into production and start generating revenues - if successful we expect HVY to significantly increase in valuation over the long term.

Even Chris Ellison’s MinRes is in on the garnet game, via its major holding of RDG.

Why is garnet important?

Major shipbuilding companies and infrastructure maintenance companies use garnet to safely reduce corrosion and extend the life of surfaces that are prone to rust.

The world has a major rust problem - aging ship fleets and big infrastructure projects like bridges are falling apart. Particularly in the US, which we see as an important target market for HVY’s garnet products.

The most recent study on corrosion in 2013, placed the costs of corrosion at roughly 3-4% of global GDP.

And it could in fact be twice as high.

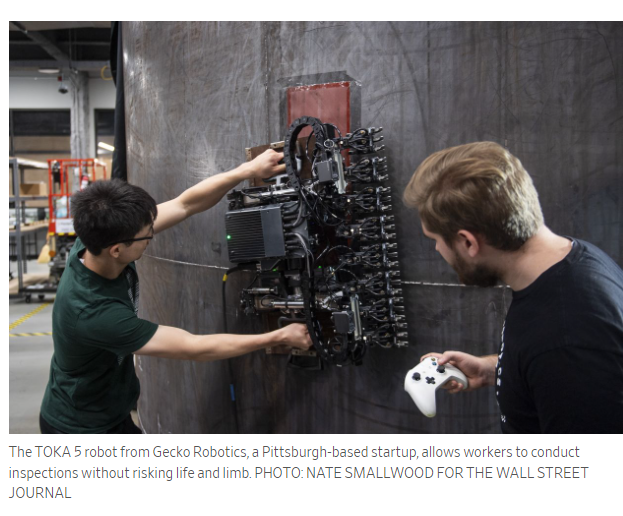

This immense cost has now gone mainstream - a recent Wall Street Journal article highlighted the cost of corrosion (particularly in the US):

Basically, newly developed robots are being used to examine US infrastructure that can identify areas of dangerous rust/corrosion.

The next step?

Blast it off - hopefully with garnet.

Aiding the cause is the most recent US budget, which has allocated US$40BN of new funding for bridge repair, replacement, and rehabilitation.

We expect this to increase demand for garnet as a sandblasting product.

This is where HVY comes in...

HVY has a recently upgraded garnet resource at its primary project which comes in at 166Mt @ 4.0% THM.

A scoping study on the project, which was done prior to this upgrade revealed the following metrics:

- After-tax project Net Present Value (NPV) of $253M,

- A payback period of 4.2 years

- An after tax Internal Rate of Return (IRR) of 33%.

- And a relatively modest project CAPEX of $110M

Those are pretty strong metrics, especially for such a niche material like garnet.

At 11c HVY has a market cap of ~$6M.

There’s also a second HVY project 37km to the south, Red Hill, where HVY has released an exploration target of 90 to 150 Mt of material at 5.4% to 4.1% THM.

Here, HVY could double its existing JORC resource across both projects if exploration goes well.

Together, we think these strong metrics and potential may have helped HVY appoint the renowned garnet expert, Aaron Williams, as a non-executive director to the Board.

Following Williams’ time at GMA Garnet Group, he went on to be Managing director of Schmidt Abrasive blasting for 8 years between 2012 and 2020 - a manufacturer and distributor of a range of industrial blasting equipment and abrasives.

More recently Williams had a role as Managing Director of Malaysian specialist abrasive blasting media supplier - which supplies almandine garnet.

Almandine garnet is the premium blasting product that HVY is seeking to supply to the blasting industry via its Port Gregory project.

Almandine garnet has notable advantages over other blasting products, such as copper slag/coal slag which have established health risks.

With likely improving economics post resource upgrade, a secondary project called Red Hill which is returning strong garnet grades, and a highly qualified garnet expert on the Board, we think HVY is now well placed to further develop its project.

To do that, HVY will need to begin a pre-feasibility study (PFS), which, like everything, will cost money.

We note HVY currently looks a bit light for cash - it held $320k as of 30 June (see risks section).

HVY has moved to address its balance sheet in recent weeks, announcing a “pre-paid royalty agreement mandate” in early August which we hope to see completed in the near term (more on this below).

This funding mechanism basically sells a small percentage of future mine revenue in return for a cash injection into the company now.

We like this kind of agreement as it is non-dilutive to existing HVY shareholders.

Royalty funding is fairly common for mining projects. A good example of a listed royalty funding provider is Trident Royalties plc. Trident owns a 60% interest in a 1.75% gross revenue royalty over one of the largest known lithium resources in North America, Thacker Pass Lithium Project.

These deals can work out for both parties assuming the mine can get into production.

If you are a s708 investor and want to consider participating in this funding (see announcement here), reach out to HVY directly. More on the royalty funding plan below.

ASX:HVY

Heavy Minerals

Here are the 13 reasons we originally Invested in HVY from our original note:

- Tiny market cap after lots of progress: HVY is currently capped at less than $11M (as of Friday, 14 July), with a scoping study already completed for its project.

Update: HVY is currently capped at ~$6M - almost half of the July market cap. - Tight structure low shares on issue (SOI): HVY only has ~57.6 million shares and ~18 million options on issue.

Update: As of the latest presentation, the top 20 shareholders hold ~75% of these shares. - Management skin in game: (As of the latest presentation) HVY directors hold ~11% of the company, with chairman Adam Schofield holding 7.2% himself.

- Garnet is an important niche material: Garnet is leveraged to big industries like the maritime and aerospace industries to allow for rust removal, industrial cutting and anti-corrosive paint to be applied to surfaces. It cannot be easily replaced.

- Favourable long-term pricing environment for garnet: Supply side is decreasing with Indian garnet production being banned. On the demand side, bans are being considered for garnet alternatives (copper slag/coal slag) due to ESG concerns. We expect to see demand outstrip supply in the coming years leading to higher prices.

- US is spending ~US$40BN on upgrading old rusty bridges: The US has budgeted US$40BN of new funding for bridge repair, replacement, and rehabilitation. We expect this to increase demand for garnet as a sandblasting product.

- Quick, viable pathway to becoming key garnet supplier: HVY’s project has an established JORC resource, a completed scoping study and is just about to start a pre-feasibility study. HVY is targeting first production in 2026.

- Close proximity to two producing garnet projects: HVY’s projects sits next door to the GMA mine which supplies ~35% of the world’s almandine garnet and Resource and Development Group’s newly constructed mine.

- Neighbour RDG trading at a ~$220M enterprise value: Resource and Development Group next door is capped at ~$150M and has an enterprise value close to ~$220M. Resource and Development Group is also ~65% owned by $13BN Mineral Resources.

- Project economics stack up, plenty of room for upside: HVY’s scoping study shows an after-tax project Net Present Value (NPV) of $253M, a payback period of 4.2 years, and an after tax Internal Rate of Return (IRR) of 33%. The project CAPEX is also relatively modest at $110M.

- Upside to its existing JORC resource - HVY could double its existing JORC resource with more drilling to the north/south of its existing JORC resource and at its Red Hill project where it has a 90-150Mt (4.1 to 5.4% THM) exploration target.

Update: In July, HVY released a 23% mineral resource estimate upgrade which brought the resource to 5.9Mt of contained garnet - which would be equivalent to 5 years of current annual demand. - Project financing support from Dutch Export Credit Agency: HVY recently received a “Letter of Support” for project funding from Atradius - the Dutch Export Credit Agency.

- ESG focus and Australian project attractive to European/US garnet buyers: Western companies are seeking sustainably produced materials, which will increase interest in sustainable produced garnet, especially given the cloud surrounding garnet that was previously produced in India.

Click here to read our first note on HVY

What has HVY done since we Invested?

Appointment of renowned garnet expert ✅

HVY’s Aaron Williams has seen it all when it comes to garnet - here is a quick summary of his roles in the garnet and sandblasting industry:

- 9 years at GMA Garnet Group between 2002 and 2011, which culminated in a role as Chief Operating Officer (COO).

- 8 years as Managing Director of Schmidt Abrasive Blasting between 2012 and 2020 - a manufacturer and distributor of a range of industrial blasting equipment and abrasives.

- Managing Director of a Malaysian specialist abrasive blasting media supplier - which supplies Almandine garnet.

Across these various roles, we think Williams would have an excellent understanding of the supply chain, and the unique value of almandine garnet in the industry.

GMA Garnet Group for example is located immediately adjacent to HVY’s Port Gregory project:

Almandine garnet is the premium blasting product that HVY is seeking to supply to the blasting industry via its Port Gregory project.

Almandine garnet also has notable advantages over other blasting products, such as copper slag/coal slag which have established health risks.

Royalty agreement mandate signed ✅

As we noted above, on the 2nd of August, HVY entered a mandate with Foster Stockbroking, who will act as lead arranger for a proposed royalty funding arrangement.

Royalty agreements generally involve a lump sum of funds going to the company upfront, in exchange for a percentage of future or existing production revenues.

Royalty agreements can be beneficial in a tough funding environment (like the current market for small caps) as it secures funding for the company without dilution - a win for long term shareholders.

The funds will help HVY develop the project and take it into a pre-feasibility study (PFS).

(Source)

HVY said it will consider a second tranche of pre-paid royalty funding following the release

of the Company’s PFS, which is expected in early 2024.

We have seen royalty agreements be successful in the past - one example is Trident Royalties deal on Lithium America’s Thacker Pass lithium project in the US.

Now Lithium America’s has taken its project into construction - which means it could start delivering returns for Trident in the near term.

Royalty agreements can be a good arrangement for both parties:

- Funding party gets a forward revenue stream which works well particularly if they have faith in the project’s ability to go into production.

- The party receiving the funds then has a stronger balance sheet to develop a project, without diluting shareholders. The funding takes it closer to a Final Investment Decision on mine construction and getting into production.

Like any investment, royalty agreements are not riskless for either party and much depends on the final terms - for example the royalty could cap the upside from future funding.

HVY said it is still determining the potential amount of the pre-paid royalty, with more details to follow in the coming weeks.

All up, as long term Investors in HVY, we are pleased that HVY is moving to shore up its balance sheet as it seeks to further develop its primary garnet project, while incurring minimal dilution for existing HVY holders.

Resource upgrade ✅

The size of HVY’s resources was strengthened on 10 July, with the company completing an upgrade of its Port Gregory JORC Mineral Resource with the total resource increasing by 23% to 166Mt @ 4.0% THM.

Notably, 126 Mt @ 3.8% THM is in the Measured category, meaning that HVY has a high degree of certainty over the size and quality of its resource.

What’s next for HVY?

Royalty agreement 🔄

Royalty agreements can be a beneficial funding method, as it can secure funding for the company without the dilution of equity - a win for long term shareholders.

Given the HVY quarterly showed the company had $320K of cash as of 30 June, we’re looking for further information regarding funding as the company aims to build a globally significant garnet mine.

Pre-feasibility study 🔄

We are looking for progress on a proposed pre-feasibility study (PFS) as the funding picture clears up, ideally through the royalty agreement.

The PFS would allow HVY to market its project to financiers, and potentially advance offtake discussions.

Progress relationship with Dutch Credit Export Agency (ECA) 🔄

We would also like to see an update on a further strengthening of the relationship with Atradius Dutch State Business (Atradius) which manages the government credit guarantee scheme on behalf of the Government of Netherlands official Export Credit Agency (ECA).

ECAs are an important cog in the global trade machine, as they provide loans, loan guarantees and insurance to help reduce the risk of exporting to other countries.

The Dutch have a large shipbuilding industry, and we think they might be interested in HVY’s garnet products.

Risks

Project Funding/Feasibility Risk

The CAPEX for the project is $110M according to HVY’s scoping study.

In order to move into production the company will need to find a way to finance this cost.

There is no guarantee that the company will be successful in this pursuit, or it may take a lot longer than planned.

Financing Risk

As a small cap exploration and development company HVY doesn’t earn any revenue, and therefore relies on the market to raise capital and advance its projects.

As of 30 June 2023 the company had $0.32M in the bank, which means that it is likely that the company will need to secure funding in the near term in order to progress the development of its projects.

Substitution/technology risk

While to our knowledge garnet is hard to substitute, it is possible that an alternative material is found or created, or a technology comes along which provides an alternative to garnet which decreases garnet’s value over time. This could impact the economics of HVY’s project.

Commodity Pricing Risk

The garnet market is opaque, where prices are dictated by private supplier contracts rather than an open liquid market.

There are a limited number of customers globally, which heightens the importance of offtake agreements to secure purchases for HVY’s products.

HVY is susceptible to supply and demand fluctuations in the garnet price, and as a niche material, it only has limited applications.

Exploration Risk

There is a chance any future drilling at HVY’s primary or secondary projects do not yield economic garnet mineralisation, impacting HVY’s total mineral resource and overall project economics.

Our HVY Investment Memo

We intend to release a HVY Investment Memo as the funding picture becomes more clear and we have a better understanding of HVY’s forward activities and timelines.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.