CPH to Acquire Canadian Cannabis Grower and Strengthen Position in Multi-Billion Dollar Market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Creso Pharma (ASX:CPH) is now in the box seat to acquire 100% of Canadian-based Mernova Medicinal Inc., an acquisition that would position CPH as a Canadian producer of legal cannabis.

Mernova is strategically placed to exploit the fast-growing Canadian market and is soon to begin constructing a highly scalable, licensed and fully compliant growing facility up to 200,000 sq. ft with the capacity to produce a minimum 2,000 kilograms of cannabis at a price per gram of C$7.87, generating revenues of C$15.74 million (A$15.9 million) per annum.

On a best-case scenario of 4,000 kilograms at a price per gram of C$7.87, revenues would be C$31.48 million (A$31.8 million) per annum. Furthermore, based on this revenue scenario CPH expects to pay off the acquisition and facility construction costs in 8-10 months.

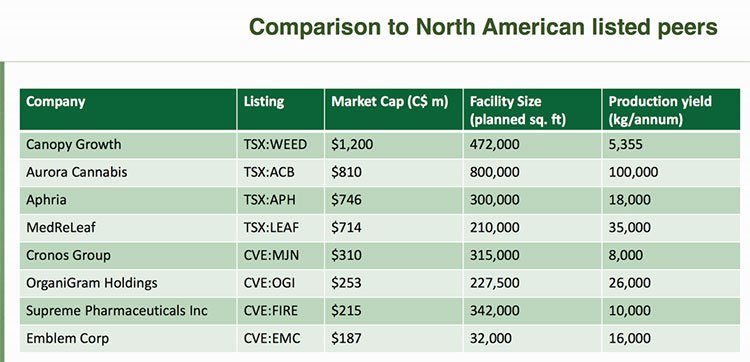

The production numbers are impressive and would put the production yield in the same league as fellow North American listed peers with hundreds of millions of dollars in market capitalisation.

For instance, Canopy Growth is worth 40 times that of CPH, but only has a growing facility five times the size.

Once the growing facility is complete, the first crop will be planted... and with crops flourishing, the company will look to secure the final licensing under Health Canada’s Access to Cannabis for Medical Purposes Regulations (ACMPR).

By obtaining this license, Mernova would be able to fast track operations and begin to produce product that meets the need of both the medicinal and recreational markets (as the recreational market comes into play). Mernova will be able to scale its production to match increasing consumer demand as a legalised recreational market comes into existence.

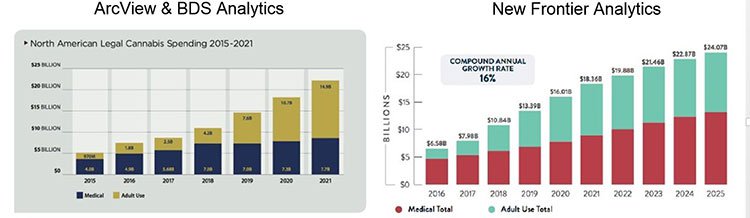

The acquisition will enable CPH to gain access to a market valued at C$4.9 to C$8.7 billion in sales, just as CPH begins to position itself as a trusted marketplace brand, with high level experience and dependable products.

However it should be noted that CPH remains an early stage company and investors should seek professional financial advice if considering this stock for their portfolio.

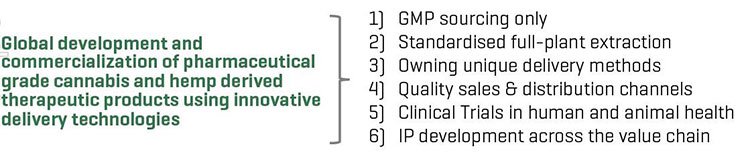

Through the acquisition, CPH will be able to create a vertically integrated company that combines a growing IP portfolio, R&D and ample production capacity. Indeed, the combination of CPH and Mernova creates a company with extensive pharmaceutical industry expertise, global sales and distribution channels and a strategic location for CPH to leverage.

The combination of these two companies should significantly enhance CPH’s revenue potential, as it looks to gain a stronghold in not only the Canadian market, but global markets also.

Updating you on:

With markets opening up and further legislation surrounding cannabis use to be in place in Canada by end of June 2018, Creso Pharma (ASX:CPH) continues to look at ways to increase its market access around the world.

Health Canada’s projections for the medicinal cannabis sector in the country estimate there will be 450,000 medicinal cannabis patients by 2024. In monetary terms, that equates to approximately $1.3 billion in sales.

As there are only 50 licensed producers currently operating under Health Canada’s Access to Cannabis for Medical Purposes Regulations (ACMPR), the opportunities for a smart operator in this field could be sizeable.

CPH has already caught the appropriate attention of potential business partners and investors.

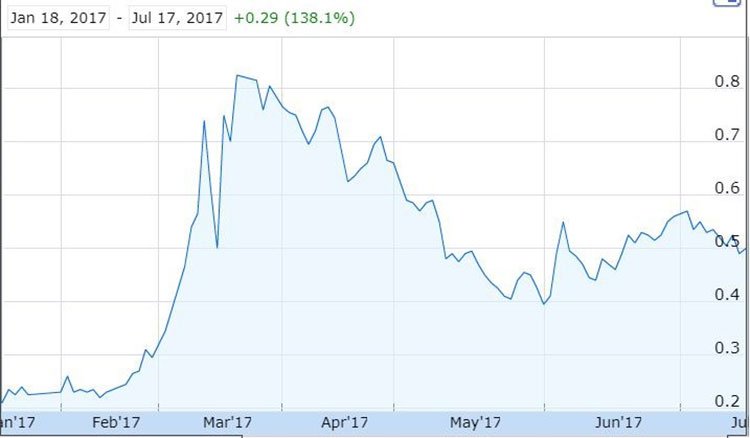

In the last 6 months, we have seen CPH reach a high of $0.82 in March. Its current share price, at ~$0.50, is a knee-buckling 138% up on where it was in January:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Could the company rise again to its circa 80 cent high and beyond, particularly with more news likely in the coming weeks and months?

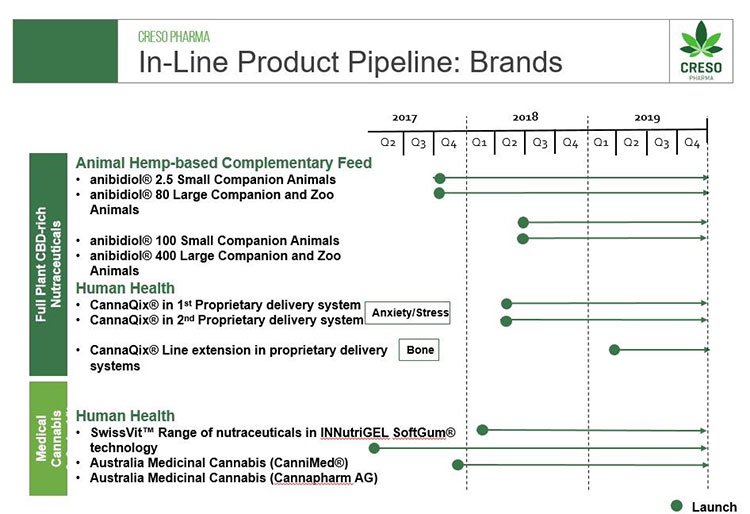

While Mernova represents a huge egg in the CPH nest, other well-incubated eggs are now ready to hatch... In late June, the company released more information regarding its upcoming product launches – stating it was on track to launch its CannaQIX® human health nutraceutical product in the area of anxiety and stress in Q1/Q2 2018 and line extensions in the area of bone metabolism in Q2 2019.

Then there’s the launch of anibidiol®2.5 and anibidiol®80, the proprietary formulated hemp-based complementary feed products for companion and zoo animals... which also remains on target for a 2017 launch. But we’ll delve into that later.

Acquisition to take CPH to new level in cannabis market

The upside from this acquisition is put in perspective with a sturdy peer comparison.

Let’s have a look at CPH’s competition in North America.

You’ll notice the top company – TSX: WEED – is a CAD$1.2 billion dollar company.

CPH’s pending acquisition of Mernova – and its 200,000 sq. ft. facility with a potential production yield of 2000 kilograms – now raises the question of whether CPH is at its true market value at its current cap of just ~AU$30 million.

The companies listed above with similar growing facility capacities have caps between ~AU$250-700 million – a huge discrepancy.

Canopy Growth (TSX:WEED) has a facility just two times the size, with a production yield at only five times that of Mernova’s... yet it’s market capitalisation is forty times that of CPH. We haven’t even mentioned CPH’s impressive pharmaceutical side, with a range of high-grade cannabis and hemp-derived therapeutic products:

Is CPH in line for a re-rate?

As for the nitty gritty of the acquisition – CPH will acquire Mernova Medicinal for a cash payment of CAD$1.8 million, and CAD$8.3 million of CPH shares. The first step will be settlement – initial cash consideration of CAD$600,000, issuance of CAD$2,400,000 ordinary CPH shares. This will be followed by the planting of the first crop following the completion of the facility (with accompanying cash consideration of CAD$600,000, issuance of CAD$2,400,000 ordinary CPH shares).

Lastly, the completion of the sales licensing process under ACMPR will happen alongside a cash consideration of CAD$600,000, issuance of CAD$3,500,000 ordinary CPH shares.

When two plus two equals... 52

When you combine CPH with its new recruit Mernova, you don’t just get the sum of the parts. What you end up with is exponentially more value.

With significant pharmaceutical industry expertise, global distribution channels, a long run of success in R&D, and a whole suite of existing high-grade products, CPH brings a maturity and sophistication to the match. Mernova brings the advantage of even greater access to the Canadian market as well as the new opportunity to compete as a grower.

Together CPH and Mernova become a vertically integrated company with an IP portfolio, a product range with depth (across human and animal health) and ample production capacity. End-product manufacturer meets ingredient manufacturer with each gaining proximity to expanded markets with proven revenue potential.

What the extent of CPH’s penetration into these markets will be remains to be seen, so investors should take a cautious approach to their investment decision based on all publically available information.

Mernova provides access to a market valued at between C$4.9 – 8.7 billion in terms of sales...

The following stats are the projections around legal cannabis spending in North America through to 2021:

Speaking of markets and macros, Canada is looking to legalise recreational use of marijuana by July 2018 . Clearly, a move that would drastically increase the addressable market by many multiples.

But not only that. It would also provide good practice for an ASX-listed company that is likely to be positioning itself towards a similar recreational-use market in the coming years...

It will be forward-looking companies like CPH that are likely to survive the landmark change, if/ when it should happen. Most commentators consider it an inevitability rather than a possibility, however when it comes to medicinal cannabis, there seems no longer any question of if but when .

Considering it’s full steam ahead on medicinal cannabis for a whole host of countries across the globe, it’s a good thing CPH has done so much legwork to create therapeutic products and build a global footprint.

Both companies working together will likely strengthen the path to regulatory approval, too. The time it takes for CPH to go from the point of innovation to actual delivery of the product will shrink, thanks to the access it will have to Mernova’s 200,000 sq. ft. state of the art production facility.

Based strategically in both Switzerland and Australia, CPH has made major inroads in both countries – each having strong regulations when it comes to growing, use and sale of cannabis.

Trust – a key ingredient in the pot pie

The world is still at such an early stage of the pot-stocks story that there are not too many well-established companies with a proven record of accomplishment... yet. The sector is dominated by new smaller companies, some of whom aren’t necessarily in it for the long haul – leaving investors understandably wary.

With a lack of untested brands, the serious-looking, relatively ‘senior’ players are going to attract more and more of the market share. Which is another reason CPH has an upper hand over its competition: it has a proven record of keeping pace with regulatory changes and shifts in the industry, which smaller or less organised bio-techs struggling to keep up with.

It is also backed by a seriously experienced team: industry leader Dr Miri Halperi Wernli as CEO, biotech veteran Mr David Russell, Dr. Isaac Kobrin (former Chief Medical Officer of Actelion Pharmaceuticals) and Professor Dr Felix Gutzwiller (former Member of Parliament in the Swiss Federal government) on the scientific advisory board.

Product launches imminent

As we mentioned early on, the company recently released news on a range of upcoming product launches.

The company said last month it was on track to launch its CannaQIX® human health nutraceutical product in the area of anxiety and stress in Q1/Q2 2018 and line extensions in the area of bone metabolism in Q2 2019.

And then there’s the launch of anibidiol®2.5 and anibidiol®80, the proprietary formulated hemp-based complementary feed products for companion and zoo animals, also remain on target for a 2017 launch.

An up-to-date timeline is below:

The good thing – no, the vitally important thing – for CPH is the fact that it is looking at a huge, and very hungry, addressable market.

The Mernova deal is big news, even for CPH, a company that is no stranger to consistent news flow.

Yet this remains a speculative stock at this stage and investors should seek professional financial advice if considering this stock for their portfolio.

CPH has a stash of related industry players who have agreed to work with it both here and abroad: Health House International (Aus), Cannapharm AG (Switzerland), LeafCann (Aus), CanniMed (Canada), INNUtriGEL (Switzerland), Streuli Pharma (Switzerland) and Domaco (Switzerland) to name just a few.

You can read about these companies in our past articles including: CPH Deliver Australia’s First Medicinal Cannabis Shipment Under New Legislation; Aussie Medical Cannabis Market Opens Up: CPH Takes Early Mover Advantage and more.

And we’re sure CPH is looking to bring even more allies aboard.

Despite having progressed so far, there is still incredible potential upside and plenty of room to get in on the action – if you don’t mind the cracking pace.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.