Introducing: Our Biotech Pick of the Year 2021

Today we announce the fourth addition to our portfolio for 2021.

We are following the investment of one of Australia's most successful small cap biotech fund managers, who has picked nearly all the top biotech multi-baggers of the last 2 years.

So far we missed them all because we didn’t listen...

Well, not this time.

This stock is the first investment made by their new early stage biotech fund...

We have also invested.

Today we are adding Dimerix (ASX:DXB) to the Next Investors portfolio as our inaugural Biotech Pick of the Year for 2021:

DXB is a $46M ASX listed biotech company that has developed a treatment for inflammatory diseases, such as kidney and respiratory diseases.

DXB’s treatment for inflammatory kidney disease has passed Phase 1 and Phase 2 clinical trials and they just raised $20M to fund Phase 3 trials over the next 12 months - into potentially a billion dollar market.

In biotechs, a Phase 3 trial is the final phase of testing a newly developed treatment on a group of people before the drug can be approved for sale to the entire population. As a treatment for a rare disease, DXB’s drug qualifies for fast track approval for sale.

Passing these Phase 3 trials and being (fast track) approved to sell their kidney disease treatment is our main bet with investing in DXB.

DXB’s kidney treatment is targeting a $1 billion plus market if it passes Phase 3 trials. From there, DXB will either partner with a big pharma company to licence their treatment or it will get acquired.

DXB’s treatment also has potential applications for lung inflammation for symptoms of COVID induced pneumonia AND COVID respiratory complications.

(yep, DXB could be treating lung inflammation symptoms from that pandemic you might have heard of... COVID)

DXB has both these COVID related treatments currently in Phase 3 trials right now and we will know the results of both before Christmas this year. We see these as two side bets for DXB to the main bet of treating kidney disease.

Both DXB’s COVID side-bets have “emergency approval” status. So, if they pass Phase 3 trials, they can get to market super fast. COVID is classed as an “emergency” by regulators so stuff gets approved much faster than usual.

We think the prior lack of funding to conduct Phase 3 trials was stopping new investors from entering DXB and the share price was moving sideways for 12 months (providing a good entry point).

With $20M funding now secured we think the NEXT 12 months of news flow in the lead up to Phase 3 trials will be eventful.

...especially with the two COVID related side bet results dropping in the next few months.

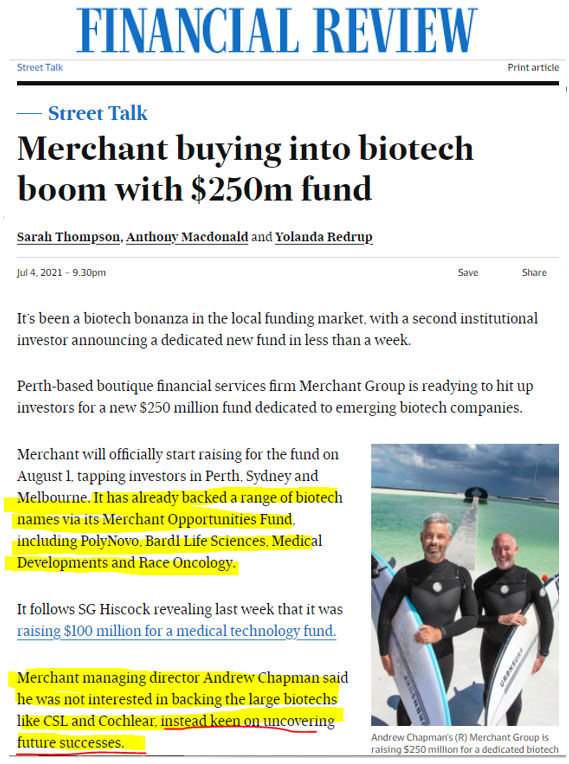

For this investment in DXB we are taking our lead from early stage biotech experts — one of the most successful small cap biotech fund managers in Australia, Merchant Group’s early stage biotech fund.

Their previous fund grew from $9M to $188M in funds under management after picking some of the best performing early stage biotechs of the last few years.

The Group’s new Merchant Biotech Fund has now made its first investment: in DXB... so we did too.

We get shown a LOT of investment opportunities from a LOT of different people.

Over the last 12 months, biotech expert and fund manager at Merchant Group, Andrew Chapman, told us a bunch of times that we should invest in another company called BARD1 Life Sciences (we said no each time).

It then went from 60¢ to almost $4 in a few weeks.

Before that Merchant also told us to look at Race Oncology (we didn’t invest in that one either) and that has been one of the ASX’s most successful biotechs in the last few years.

We get shown over 400 potential investments per year and we say no to a lot of investments... However, we have observed that the companies that Merchant recommends have gone on to perform extremely well.

...so when Merchant approached us a few months ago to join in the due diligence process looking at DXB with them, this time we decided to get involved.

Merchant tells us that DXB has one of the cheapest market caps they have seen for a biotech company that’s entering Phase 3 trials. They decided to invest $6M cold hard cash into this week's DXB placement as the FIRST investment in their NEW early stage Merchant Biotech Fund.

As part of the due diligence process, we’ve had a few meetings with the DXB CEO Nina Webster and have been very impressed with her track record of commercialising biotechs in the past, including Immuron and Acrux.

Our new biotech advisor likes it too.

To help us analyse DXB and other potential biotech investments we have also brought on our very own experienced biotech advisor. When asked what he thought of DXB, he said he is currently a DXB shareholder and has already been invested in for about two years — another good sign.

We are also pleased to announce our new early stage biotech focused portfolio at Finfeed.com, where DXB is our first investment and initial portfolio addition.

For these reasons above we have invested in and are calling DXB our Next Investors’ Biotech Pick of the Year for 2021.

SUMMARY: 9 Reasons we have invested in DXB

- We are following the lead of experts at the Merchant Group, DXB is the first investment in their new early stage biotech fund and they have an excellent track record.

- We have spent some time with DXB CEO Nina Webster and are very impressed with her industry experience in commercialising biotechs

- DXB MAIN BET: Addresses an inflammatory kidney disease to address a $1 billion market if successful. Phase 3 trial results due in 12 months with investor speculation building in the lead up to the result.

- DXB SIDE BET #1: Phase 3 trials of lung inflammation treatment for patients in hospital from COVID — results due in a few months.

- DXB SIDE BET #2: Phase 3 trials treatment for patients with pneumonia associated with COVID — results due in a few months.

- Share price consolidated during 2021 and $20M in the bank — ready for next leg up with funding.

- We think life science and biotech will be a big theme over next few years.

- Our new biotech expert advisor tells us the DXB science is very good. (They provide some technical details).

- We think that if it proved the treatment, DXB could be acquired by big pharma for hundreds of millions.

9 The reasons we invested in DXB

1. We are following the lead of successful early stage biotech experts at the Merchant Biotech Fund

The team at Merchant has an amazing track record of investing in early stage biotechs.

The Fin Rev says that Merchant’s first fund went from $9M funds under management to $188M.

Over the last 18 months Merchant recommended a couple of their biotech picks for our portfolio but we didn't invest (we get shown over 400 investment opportunities per year and say no to nearly all of them).

Here’s what happened, plus some of Merchant’s other success stories:

BARD1 Life Sciences (BD1): $0.50 - $1.45 ($5.60 high) - we said no 🤦♂️

Race Oncology (RAC): $0.14 - $3.35 ($4.20 high) - we said no 🤦♂️

Polynovo Ltd (PNV): $0.04 - $2.30 ($4.05 high) - we said no 🤦♂️

BCL Diagnostics (BDX): $0.029 - $0.18 ($0.27 high) - didn’t offer it

Prescient Therapeutics (PTX): $0.05 - $0.20 ($0.28 high) - didn’t offer it

NEW: Dimerix (DXB) - ?

DXB is the first investment in Merchant’s NEW dedicated early stage biotech fund that was launched just last month.

Based on their past success, we are planning to follow their early stage biotech investments closely in our new dedicated early stage biotech portfolio, Finfeed.

Just weeks after launching its new $250M Merchant Biotech Fund, the group has made its first investment in DXB. Securing itself as a cornerstone investor in the $20M capital raise.

The confidence displayed by Merchant in putting in $6M into DXB gave us an extra dose of confidence to participate in the cap raise ourselves and add the company as our Biotech Pick of the Year for 2021.

Merchant managing director Andrew Chapman said of the new fund, “We will favour biotech positions away from the biggest names... believing that most blue-chip investors will already have some of these names in a portfolio and shouldn’t pay a fund manager to invest in them.”

2. We have spent some time with DXB CEO Nina Webster tand are very impressed

Nina joined DXB in 2018, bringing thirty years of experience in the pharmaceutical industry and impressive track record of large, commercial biotech deals.

She was the Commercial Director for Acrux Limited (ASX: ACR), where she had a lead role in multiple commercial transactions with global pharmaceutical companies that collectively netted over $300M in revenue.

Prior to Acrux, Nina was Director of Commercialisation and Intellectual Property for Immuron Limited (ASX: IMC), and previously spent six years in new product development with Wyeth Pharmaceuticals in the UK (now owned by Pfizer).

Nina holds a Ph.D in Pharmaceutics from Cardiff University, a Bachelor degree in Pharmacology, a Masters degree in Intellectual Property Law from Melbourne University and an MBA from RMIT.

We speak to a lot of CEOs of different companies and basically, we think she stands out from the rest.

Her experience and knowledge in both the scientific and commercial aspect of early stage biotechs gives us the confidence that our investment is in the right hands. And she was really patient in helping us understand the DXB offering and the potential future applications in new markets.

3. MAIN Bet: Addresses an inflammatory kidney disease with a $1 billion plus market

What is FSGS?

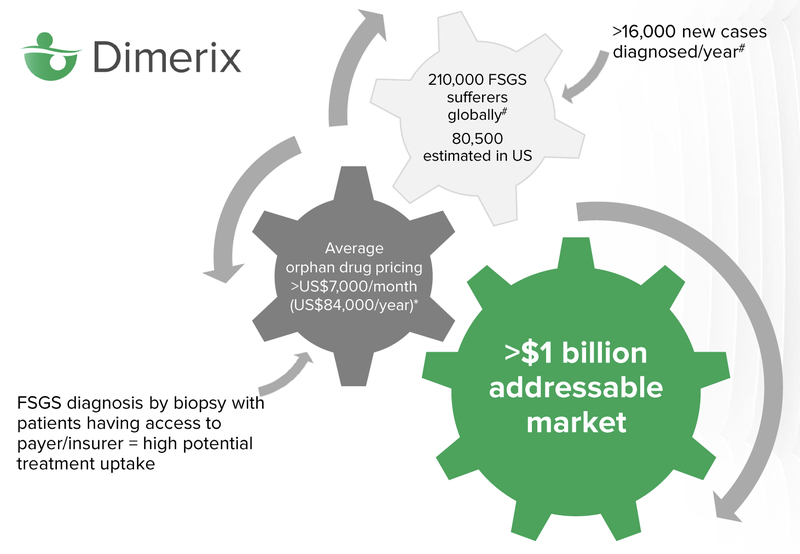

Focal Segmental Glomerulosclerosis (FSGS) is a rare kidney disease (orphan disease) characterised by inflammation and scarring of the kidney’s filtration unit. There are currently no FDA approved therapies, and the only solution for people with this debilitating kidney disease is a kidney transplant (which is very expensive and requires a long waiting-list).

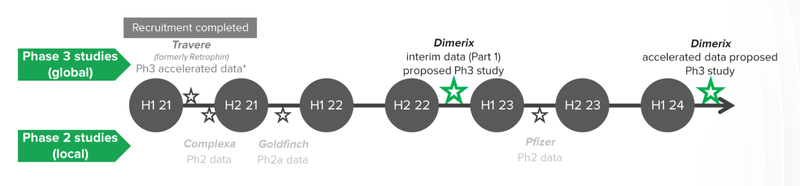

DXB is set to commence Phase III Clinical Trials to test whether their drug known as DMX-200, can improve patient kidney function. The benefits of treating an “orphan disease” like FSGS is that DXB has the potential for accelerated approvals by the FDA.

Accelerated approvals, means that DXB will be able to commercialise the drug before the final trial results, saving months and even years of clinical research.

Commercialisation

There are 210,000 global sufferers of FSGS, it’s estimated that 80,000 of those live in the United States.

Orphan drugs are expensive, over $7,000 per month on average. The average person will not be able to afford treatment, however insurance will generally cover the cost of drugs approved by the FDA, that treat orphan diseases. In the US, insurance is often covered by a person’s employer, so there is a high potential for treatment uptake.

The key milestone for investors to keep an eye on is the “Accelerated Approvals Granted” by the FDA, which means that DXB can start commercialising the drug and selling it to people diagnosed with FSGS. The total addressable market for the drug, according to Dimerix, is north of $1 billion.

Orphan drugs and recruitment

For an orphan disease like FSGS, recruitment can be very competitive. The rare nature of the disease makes it such that getting enough patients to conduct Phase 3 Clinical Trials can make or break a project.

DXB is in a critical window for patient recruitment as there are no other global FSDS studies underway. We will be monitoring announcements closely for patient recruitment updates once the trial has commenced.

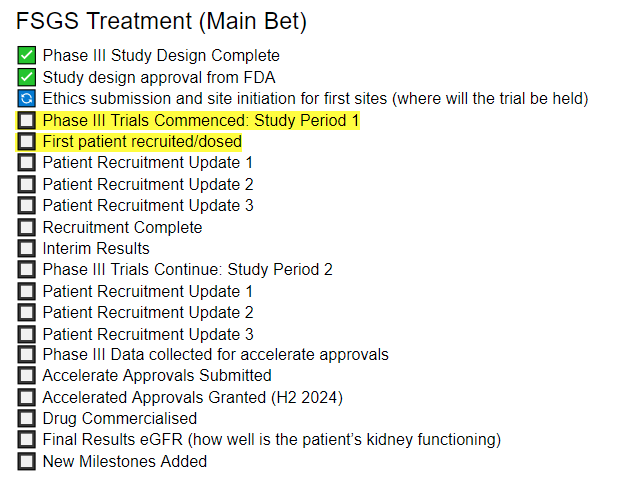

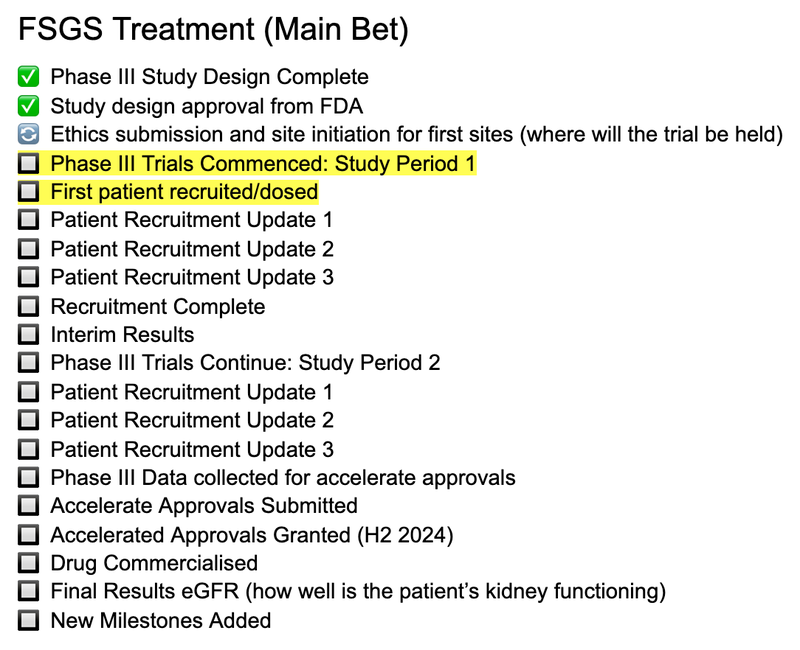

Here are our expected milestones we will be following for our main DXB bet:

Other applications in kidney disease

DXB’s technology also has applications in Diabetic Kidney Disease , which has much wider commercial applications than for FSGS.

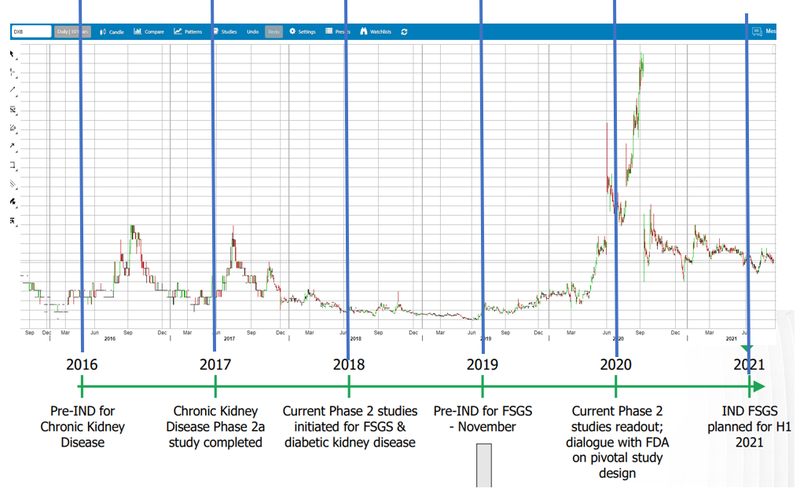

DXB completed Phase 2 trials for Diabetic Kidney Disease in September and the technology is ready for Phase 3 trials (there was a big price spike just before DXB rerated from ~10¢ to settles at about 25¢)

However, as Diabetic Kidney Disease does NOT have orphan status, it is not eligible for accelerated approvals. So while the market is WAY bigger than for FSGS, it will take longer to approve given the scale of people by which it could be used.

4. DXB SIDE BET #1: Treatment of lung inflammation from COVID - Phase 3 results due in a few months

A molecule (like DXB’s) that can reduce inflammation has many potential uses, and after COVID came along and started inflaming peoples lungs and causing shortness of breath, it was a natural next step for DXB to trial applications for reducing COVID related respiratory issues and inflammation.

We all know that COVID symptoms make it hard to breathe - inflaming the lungs.

Phase 3 trial results of DXB’s COVID applications are due before Christmas, and any COVID related treatments get “emergency” status fast track approval by regulators.

While for us, DXB’s COVID applications are a side bet, we are pretty excited given we will find out the results in the next couple of months, and because COVID is such a big deal.

We are going to deep dive into the COVID related side bets in our next article.

Essentially this is a “free bet” given the funding for these trials is coming from external sources.

We also note that (ironically) there have been delays in patient recruitment for the COVID trial... due to COVID.

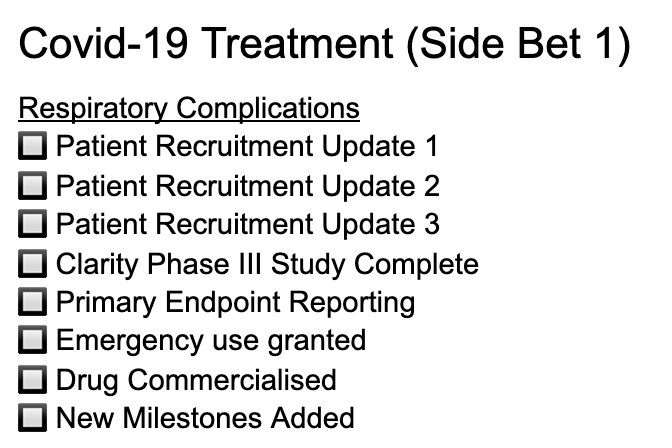

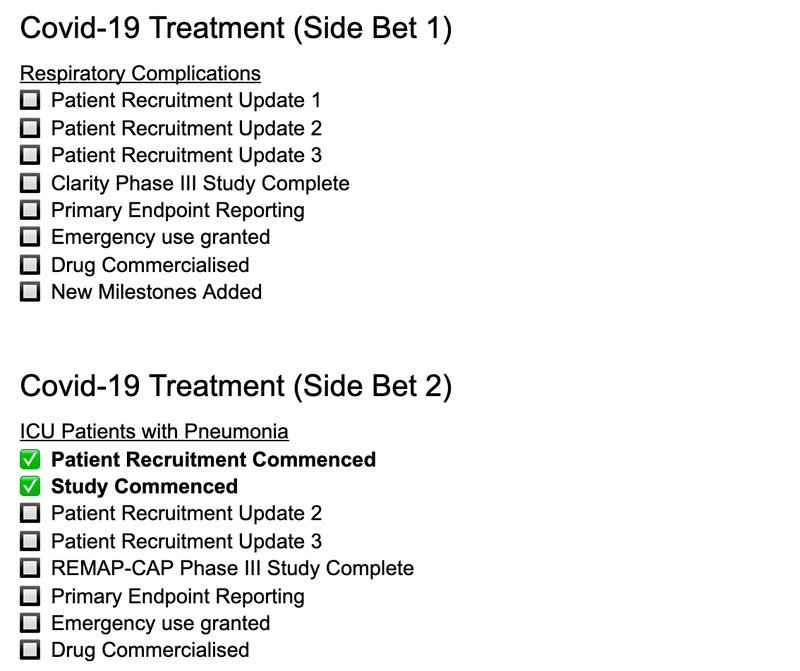

Here are the expected milestones we will be following for our DXB side-bet #1:

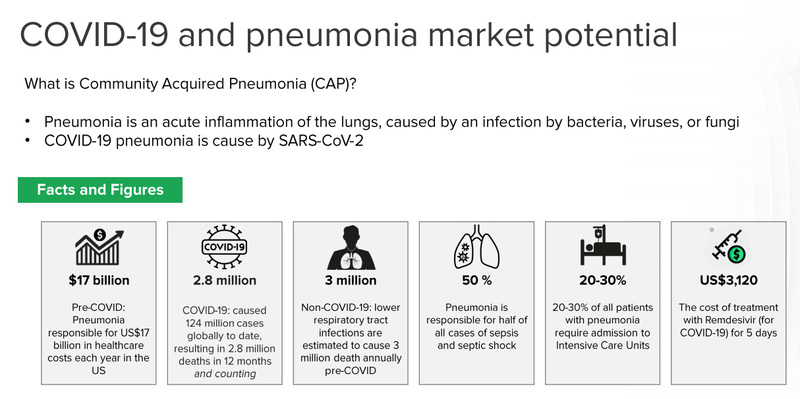

5. DXB SIDE BET #2: Treatment for COVID associated Pneumonia - Phase 3 results due in a few months

DXB’s primary technology (DMX-200) is also being applied to patients with pneumonia associated with COVID-19 in intensive care units.

This overarching study incorporating DMX-200 is primarily funded through the European Union, and a $1M grant from the Australian Government’s Medical Research Fund.

We see this as another ‘free bet’ for DXB and are keeping a close eye on the progress of the Phase 3 trials.

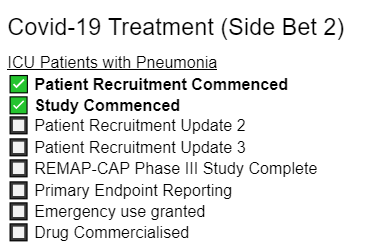

Here are the expected milestones we will be following for our DXB side-bet #2:

6. Share price consolidated during 2021 - ready to move again?

The Phase 2 trial results for DXB’s Diabetic Kidney Disease drove up the DXB share price from March 2020 to Sept 2021, and the DXB share price settled at around ~25¢ after trading at around 10¢ for the previous year (with a big spike up to almost 80¢ before the trials).

We think of biotech Phase (1,2,3) trial results like exploration results in resources — there is huge promise if they get it right, and speculators get excited, the price spikes, the results come in and the share price settles back at (hopefully) a higher sustained level than before the results.

Long term holders (like us) are happy with re-rated share price from results (even if there is a spike in between). Some traders or new investors get burned trying to make a quick buck on chasing the price spike, then get frustrated holding the bag.

So, what were the results?

The top line result from the Phase 2 trials showed no statistical drop in proteinura levels across the entire patient cohort. A statistically significant drop in proteinura levels was expected by the market as a “success”.

It’s never a good sign when you read the words “no statistical significance”. However, diving further into the data, 64% of patients with a more severe case of the disease showed a statistically relevant reduction in their proteinurea levels, compared to those with a more mild case of the disease.

We think that this indicates that the primary endpoint failure was due more to the design of the trial rather than the results itself. We are interested to see how this result will inform the design of the Phase 3 Clinical trials, which we anticipate will take a back seat as the company focuses on their FSGS trials.

Most investors didn't seem to appreciate this and bailed - fine with us as it has provided a much better entry point for incoming investors like us almost a year later when significant progress has been made by DXB.

We like DXB because it has moved sideways for a year. All the hot money left after the spike, and the share price has stagnated since then the company didn't have money to do the 12 month Phase 3 trials - so everyone has been waiting for them to raise $... which they have just done.

7. Life science and biotech will be a big theme over next few years

COVID-19 has brought life sciences and vaccine development into the forefront of everyone in the world, we think that the next ten years will be a surge in investor interest in life science investment.

Can you think of any other time when practically every single person you talk to has knowledge and interest in vaccines, virus transmissions, disease, clinical trials, health issues etc?

We believe COVID has baked life sciences into the psyche of an entire generation of investors - which is why we are making our first biotech investment today into DXB and have started our dedicated early stage biotech portfolio at finfeed.com with DXB as its first investment.

8. Our biotech expert tells us the DXB’s science is very good - here are the technical details ...

As part of our investment in DXB and our new early stage biotech focused portfolio at Finfeed, we have engaged a biotech advisor who is helping us assess companies in the space - here is the technical view on DXB:

DXB holds multiple assets identified through their proprietary Receptor-HIT technology, but the one which is furthest advanced and that we are currently most excited about is called DMX-200. It acts as an antagonist - meaning that it binds to a target and blocks its function - and is directed against a key receptor called CCR2, which is implicated in fibrotic diseases. DMX-200 is administered in conjunction with Irbesartan, an Angiotensin II Type 1 Receptor Blocker (ARB), which is the current standard of care for kidney disease.

How do we know it works? Last year, Dimerix completed a Phase 2a study in FSGS patients, where DMX-200 + ARB was compared to ARB therapy alone. One of the readouts of this study was the relative level of protein in patient urine (proteinurea) - damaged kidneys don’t function as effectively, so the worse the disease, the more protein there is in their urine. The results from this study were impressive - 86% of patients had some reduction in proteinurea relative to the control arm, and 29% of the patients had >40% reduction in their proteinurea levels - which is an excellent result. In both cases those figures refer to the additional benefit of DMX-200 on top of the effect of the existing standard of care.

Dimerix have now advanced DMX-200 into a Phase 3 trial for FSGS - this will involve a larger study with more patients, to confirm the efficacy seen in the previous study, and pave the way for commercial licensing.

Please respond to this email if you have any question for our biotech expert on the DXB science and we’ll include responses in our next note.

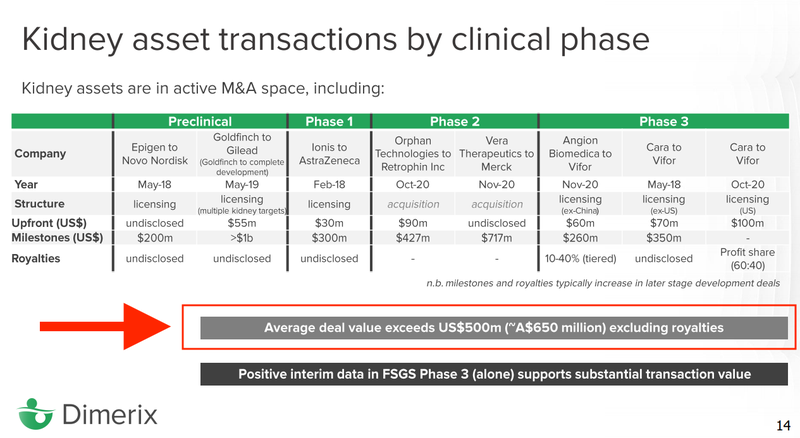

9. Exit Goal: We think that if it proved the treatment DXB will be acquired by big pharma for hundreds of millions

The general life cycle for an early stage biotech is to increase their share price as they work through phase 1,2 then 3 trials.

If the phase 3 trials are successful they will usually license their product to a big pharma company (who has a huge distribution network) OR the big pharma company will just buy them outright.

DXB’s investor deck says that average deal value for an acquisition is $650M and that with positive FSGS phase 3 trial results DXB supports a substantial transaction value.

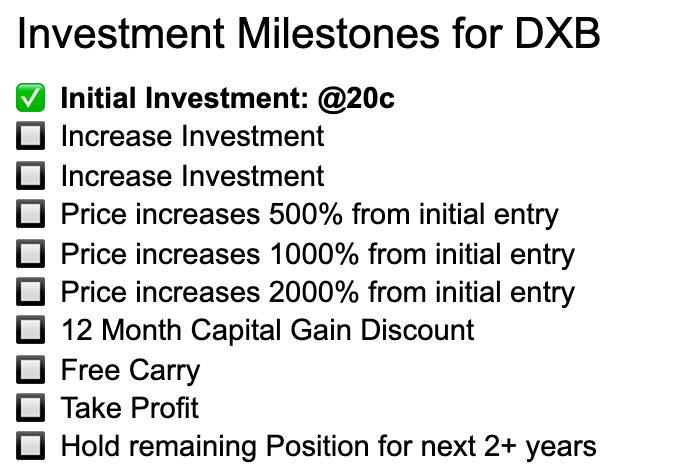

Here is our investment strategy for DXB

We think there is potential for DXB price to run in the lead up to FSGS Phase 3 trial results in 12 months time.

Here is our investment strategy for DXB:

- Invest just as DXB raised $20M so they are full funded, removes the funding question mark

- DXB MAIN BET: is for the kidney disease phase 3 trials, there will be updates along the way but the main excitement will be in the lead up to results in 12 months - think of it like the lead up to drilling results in exploration

- DXB SIDE BET #1: Treatment of lung inflammation from COVID - phase 3 results due in a few months - potentially free carry in lead up to results

- DXB SIDE BET #2: Treatment for COVID associated Pneumonia - phase 3 results due in a few months - potentially take small % profit in lead up to results

Depending on the share price performance we will consider to free carry just before the first COVID result, and take some profit just before the pneumonia from COVID result, but hold the majority until the Phase 3 trial result for the FSGS kidney disease is released.

If the price runs to over $1 prior to the Phase 3 results in 2022 we will take some more profits, but as always we will hold the majority of our position in to the results.

As we always do, if the company is performing well we will look to increase our position in future capital raises.

Here are our company milestones for DXB

As always, we are going to share the journey of our investment in DXB (we are long term holders 2 to 3 years) and we will provide our commentary as they deliver on these milestones:

(news announcements we expect next are shown in yellow)

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.