MXC to Build Malta Production Facility to Capitalise on $55B Global Pot Market

Published 12-APR-2018 10:50 A.M.

|

16 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Fast-moving medicinal cannabis innovator MGC Pharmaceuticals (ASX:MXC) smashed a circle of milestones in 2017, and is steadily coming into its own as it emerges as an industry leader.

Last year, MXC penned a cluster of strategic deals across its three key business divisions — MGC Pharma, Derma and Botanicals — and began generating revenues.

Continuing this momentum, MXC has wasted no time ramping up its game into 2018.

This week, MXC was awarded a contract by the government of Malta to construct a 4,000 sq. metre state-of-the-art medical cannabis production and cultivation facility – making it one of only five companies, and the only company from Australia, to be awarded a full medical cannabis production and cultivation contract.

MXC has successfully raised $5 million to establish the facility.

The Malta licence is an important milestone as MXC will be permitted to produce all THC and CBD strains of medical cannabis, enhancing its ability to develop additional medical cannabis pharmaceutical products into key European and global markets.

That market alone is worth over €50 billion (A$80B).

This follows big news just last month, when the company launched MGC Nutraceuticals, a new line of CBD and hemp-enhanced vegan products targeting the high-end dietary supplement market.

This premium product offering is based on high-grade phytocannabinoids, proteins and vitamins. It also meets the EU’s exacting standards, with health claims complying with EU legislation.

Given that the global nutraceutical market was valued at some US$383 billion in 2016 and is expected to grow to around US$561 billion over the next four years, this launch is a strategic move indeed from this nimble ASX pot-stock.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

On the MGC Pharma front, the company has taken a major step towards full manufacturing certification, clinching an initial Good Manufacturing Practice (GMP) licence for its European laboratory and compounding facility.

This cleared a direct path for the production of the first batch of MXC’s adult medical cannabis epilepsy product, CannEpilTM, which happened in late March. Analysis of this batch will commence shortly and will be the final step in the process before full certification is granted. This will make MXC one of the most advanced in Europe for pharmaceutical-grade medical cannabis production.

If all goes well, MXC expects its European facility to be granted full GMP certification not long thereafter... which could pique shareholder antennae in a serious way.

The CannEpilTM product targets drug-resistant adult epilepsy, which accounts for around 30% of the 25,000 cases that are diagnosed in Australia each year.

Importantly, this will mark the launch of MXC’s first pharmaceutical-grade medical cannabis product in Australia, and is set to generate considerable revenues. Around $1 million per year is expected from its first full year of distribution with specialist Australian pharmaceutical distributor, HL Pharma.

On top of that, MGC Pharma’s $8 million agreement with Korean cosmetics manufacturer, Varm Cosmo, is moving along well. Varm Cosmo will be launching its premium range of CavaLabs Derma products in the coming months, which will make use of pure CBD supplied by MGC Pharma.

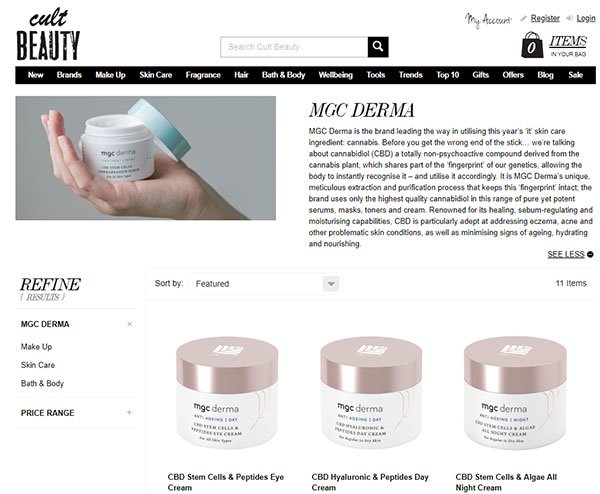

As for MGC Derma, last month, 15 MGC Derma and Derma Plus cosmetics and skincare products were officially launched on renowned online cosmetics store, Cult Beauty.

This follows MGC Derma’s strategic six-month distribution deal with Cult Beauty back in January. MXC is already seeing a material increase in month-on-month sales revenues following the launch.

MXC’s Derma division has also officially launched the first product in its new Derma Plus range, the CBD-based Herbal Repair Cream, for relief of psoriasis. Another two products are on track for launch in the first quarter of the year.

With this veritable laundry list of accomplishments, the ASX small-cap has been on a considerable high, and that’s really only just a taste of what’s been on its radar.

MXC also stands to benefit from a recent significant legislative shift: the Australian Federal Government giving the green light for medical cannabis exports.

This move positions Australia to emerge as a leading global supplier of medical marijuana in a bid to score a piece of the US$55 billion global market.

These changes also mean serious business for MXC, which could stand to claim a sizeable slice of this multi-billion-dollar pot pie.

With a clear legislative and regulatory framework in place, MXC can now fast-track its long-held plans to develop a pharmaceutical-grade medical cannabis cultivation and manufacturing strategy in Australia to complement its existing operations in Europe.

All in all, the year has been off to a buzzing start for this $95 million-capped bright biotech spark, with $8 million cash in the bank to help it along in the lead-up to its first production of CannEpil... and things are only going to continue heating up from here.

Let’s get re-acquainted with:

We last checked in with MGC Pharmaceuticals (ASX:MXC) in November with the article, Budding ASX Junior Pens Transformative Medical Cannabis Deals: Now Generating Revenue.

In that piece, we took an in-depth look at the three core divisions of MXC’s business, as well as the game-changing, revenue-generating deals that it had clinched across these facets. We also looked at CannEpil product, and at the considerable market it pertains to.

We’re not going to rehash all of that information here, but something worth bearing in mind is the sheer diversity of these business divisions. Part of what makes this ASX pot-stock unique is that it has research initiatives into both medicinal and cosmetic applications for marijuana, and this gives MXC a distinctive point of difference when compared to its peers.

And investors seem to be nodding in agreement. The past year has taken MXC shareholders to new highs — kicked off by the $40 million supply deal with Korea’s Varm Cosmo in October 2017:

The past performance of this product is not and should not be

taken as an indication of future performance. Caution should be exercised in

assessing past performance. This product, like all other financial products, is

subject to market forces and unpredictable events that may adversely affect

future performance.

The past performance of this product is not and should not be

taken as an indication of future performance. Caution should be exercised in

assessing past performance. This product, like all other financial products, is

subject to market forces and unpredictable events that may adversely affect

future performance.

This year, in turn, is set to be pivotal for MXC’s growth as it cinches a series of major landmarks.

Let’s take a look now at the most recent developments on MXC’s radar: ones which make for an excellent example of the kind of diversification we just talked about ...

Cultivation in Malta

There is big news and then there is news that provides pivotal moments for a company. MXC’s Malta move could be a game-changer after it was awarded with 4,000 sq. metre of land to construct a state-of-the-art medical cannabis production and cultivation facility.

Having raised $5 million (before costs) via a share placement of 7 cents per share, MXC is now well positioned to establish the production facility in accordance with the new contract.

MXC emerged successful after a competitive tender as one of five entities and the only Australian company approved to build and operate a fully-licenced medical cannabis facility in Malta.

The licence enables MXC to produce all THC and CBD strains of medical cannabis, which could provide significant positive advantages for its overall global ambitions as it looks to become a fully vertically integrated medical cannabis seed to sale operation in the EU.

The medical cannabis from this operation will be used in the production of MXC’s GMP-grade pharmaceutical products at a commercial scale, and enable the supply of medical cannabis flowers to emerging European markets.

Malta is in the throes of the final stages of legislative change with regard to medical cannabis laws.

Headings like this indicate just how serious Malta is about change:

And this:

MXC will be required to comply with its licences and permits to operate the facility including employing 25 Maltese people as part of the local workforce. This should be no issue as MXC looks forward to producing THC and CBD strains in the EU, where the estimated yearly value of the medical cannabis market is €56.2 billion.

The Malta licence could be the play that sends MXC into the next realm of medical cannabis supply and fully complements its operations in other areas including its production facility in Slovenia and its move into nutraceuticals.

However the stock remains speculative and investors should approach their investment decision in this company with caution.

MGC Nutraceuticals: leverage to a new multi-billion-dollar market

MXC recently launched MGC Nutraceuticals, a new premium product line of CBD and hemp-enhanced nutraceutical products for retail customers.

This new range immediately expands MXC’s consumer product offering into the global US$561 billion dietary supplement market with seven new high-end natural vegan products.

Based on high-grade phytocannabinoids, proteins and vitamins, all of these products have been formulated for daily use, and to promote normal immune system function, improve stress protection, and maintain muscle and bone structure.

MXC has launched a new e-commerce platform for the range, as well as a full product catalogue.

An important thing to bear in mind here is that MXC’s expansion into this market leverages its existing capabilities, including IP, manufacturing capabilities and marketing distribution...

Meaning that this innovative company has been able to develop an entirely new range of products for an entirely new market, with minimal additional investment.

Euro facility on verge of full GMP certification: produces first batch of CannEpil

One of the biggest milestones on MXC’s path this year will be full GMP certification for its recently completed world-class Slovenian medicinal cannabis production facility. And with its receipt of interim certification in January, it’s almost there.

Importantly, final GMP approval is also one of the final regulatory hurdles for MXC in its journey to commercially produce CannEpil.

Once GMP certification is granted for the laboratory and compounding facility, it will be one of the most advanced in Europe for pharmaceutical-grade medical cannabis production.

MGC Pharma will then focus on certification for its European extraction facility, marking the final step in the 18-month-long approvals process.

A major benefit here is once both certifications are received, the company will have a fully integrated GMP facility for the future extraction, compounding and production of new pharmaceutical grade cannabis-based medicines... from CannEpil and beyond.

In the meantime, interim certification paved the way for MXC to begin production of its first batch of CannEpil, which it has just delivered. The product will now undergo validation of manufacturing and rigorous analysis before being approved for wider production.

A product that’s been years in the making, CannEpil is MXC’s first medicinal cannabis offering, which has already been approved for use in Australia.

The product targets drug-resistant forms of epilepsy (also known as refractory epilepsy), which accounts for around 30% of all epilepsy cases — meaning some 70,000 potential patients in Australia alone.

According to GlobalData, cases of refractory epilepsy are also set to rise by more than 100,000 by 2026.

Given that CBD has recently been proven to reduce the severity of seizures, moreover, the timing of CannEpil’s entry into the market is especially salient.

Late last year, MGC Pharma penned an exclusive supply agreement with HL Pharma, to bring this medicinal cannabis product to the Australian market.

Finfeed.com covered this piece of news in detail:

(Finfeed is a related entity of S3 Consortium Pty Ltd as defined in Section 9 of the Corporations Act 2001)

Under the agreement, HL Pharma is responsible for ensuring Therapeutic Goods Administration (TGA) and Office of Drug Control approval to import and supply the products in Australia.

In turn, once it’s received all the necessary regulatory approvals, supplying CannEpil to the Australian market is set to generate significant revenues for MXC, expected to be around $1 million per year from its first full year of distribution. Notably, this is from less than 100 patients already registered through its relationship with Epilepsy Action Australia (EAA).

Full GMP certification for MGC Pharma’s extraction facility remains on schedule, with all equipment and systems now fully installed.

The finished product will put this ASX small-cap in an advantageous position to tap key markets in Europe, North America and Australasia, where such sales and distribution are permitted and legal... which means its small-cap days could very well be numbered.

Another pivotal deal and product launch: Cult Beauty

Back in January, MGC Derma penned a strategic distribution agreement with renowned online cosmetics store, Cult Beauty. Available to consumers worldwide, this deal sees 15 of MGC Derma’s cannabidiol cosmetic products sold on the Cult Beauty site, as well as its Derma Plus skincare range.

The launch of the products on the Cult Beauty platform kicked off in early February...

The Cult Beauty launch is supported by an exclusive six-month marketing campaign, which is already driving a direct increase in MGC Derma sales.

Cult Beauty, meanwhile, is a UK-based online beauty store that specialises in selling cutting-edge and hard-to-find beauty products to global consumers. Cultbeauty.com is a meticulously curated experience that distils the global beauty industry down to its brightest: from the latest scientific discoveries to hundred-year-old remedies.

Cult Beauty carefully selects each and every product marketed through its platform, so this elite seal of approval makes for a clear endorsement of MGC Derma’s products.

This deal with a world-renowned beauty products e-tailer, moreover, provides MGC Derma with a new platform for marketing its ever-expanding range of CBD-based skincare products, and to a new, more diverse global cosmetics market.

Also working nicely to MXC’s advantage is that that this deal (as well as the Varm Cosmo deal) is tapping another major global market: specifically, the cosmetics market, which was worth US$460 billion (~A$597B) in 2014, and is expected to surge to US$675 billion (~A$875B) by 2020.

A green light... and new green possibilities

As we mentioned earlier, Australia’s budding medicinal cannabis corridor has been given a major leg up by way of a milestone legislative change: the Australian Federal Government’s legalisation of medicinal marijuana exports in a bid to score a chunk of the US$55 billion global market.

This will make Australia just the fourth country in the world to legalise medicinal marijuana exports — a development supportive of ASX pot-stocks, including MXC.

All of this also attracted ample media coverage, as Australia’s pot producers welcomed the good news.

Here’s the Australian Financial Review’s take:

And the title of this Guardian article is pretty self-explanatory...

Finfeed.com, on the other hand, looked at this change alongside the legalisation of recreational pot in California, which kicked in with the new year...

This move follows on from the government’s decision to open Australian borders to controlled imports of approved medical cannabis products last year. This enabled MXC to move towards making products available to Australian patients ahead of the establishing its Australian manufacturing operations.

These new export laws mean that Australia’s domestic medical cannabis producers will now be able to expand internationally to booming markets in Canada, Europe and the US.

To get an idea of what this could mean, the global medical cannabis market is expected to reach almost US$60 billion by 2025, according to Grand View Research.

However, how much of the market MXC is able to corner is speculative at this stage and therefore investors shouldn’t act on this fact alone, but should take all publicly available information into account and seek professional financial advice.

So, what exactly does all of this mean for MXC?

Firstly, in addition to supplying its Australian pharmaceutical pipeline, MXC will now also be able to expand sales of Australian manufactured medical cannabis products like CannEpil into major global markets.

In a longer term capacity, MXC can now intensify its focus and pick up the pace in developing a pharmaceutical-grade medicinal cannabis cultivation and manufacturing operation in Australia, alongside its established operations in Europe.

Cultivating an Australian operational base has always been part of MXC’s longer-term plans, but federal legislative changes hadn’t made it commercially viable... until now.

MXC is now hoping to be able to supply CannEpil (and other products to come) directly to the Australian market from a future Australian-based operation. This, in turn, would provide significant cost and logistics benefits to export into key Asia Pacific markets over MXC’s European operations.

A taste of things to come

As you may have gathered, MXC is a company that likes to keep itself very busy, and what we’ve been looking at here is really only a sampling of what it’s been up to.

Some other intriguing developments that have been brewing...

- MXC has been making steady progress on

three key project initiatives over the past six months in its collaboration

with RMIT, including the strategic Library of Cannabinoids.

- Partnership discussions have also begun between MXC, RMIT

and leading Israeli research universities to deliver new medical cannabis

technologies to critical markets.

- Extraction of cannabinoids from last year’s Czech

botanical production is set to be done and dusted in Prague this month — these will be used to manufacture new

products.

- MXC has applied for a medicinal cannabis

research cultivation licence to the Australia’s Office of Drug Control (ODC).

- The company’s research collaboration with the University of

Ljubljana is progressing,

with the experimental crop using MXC genetics now entering the middle of its

flowering stage.

- Potential strategic investment and JV opportunities are in the works with established licensed producers in Australia and North America.

In short, that's a full dance-card for one ASX small-cap, with a lot to keep it busy over the coming weeks and months.

The phrase "game-changing" is a cliché, but it is certainly apt with regard to MXC's Malta licence and could really swing the door wide open in the multi-billion dollar European medical cannabis market.

Production of the first batch of CannEpil, full GMP certification, not to mention the launch of new Derma products, are not long away — all of which could be potential share price catalysts for MXC.

These are still early days, and despite the strong year the stock has had, MXC is still capped at a modest $95 million. Yet it’s wasting no time in firmly establishing itself as a force to be reckoned with — and here at the Next Biotech, we can’t wait to see what the rapidly maturing MXC will do next.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.