ANP to Rapidly Advance to Phase IIb Trial After Dosing Results Exceed Expectations

Published 19-DEC-2019 09:47 A.M.

|

15 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

An escalating number of patients are being diagnosed with chronic conditions such as heart disease and new cases of diagnosed cancer are on the rise.

Such drivers are leading to an increase in the global demand for novel therapies such as antisense drugs, which prevent the production of proteins involved in disease processes — in order to provide a therapeutic benefit.

Huntington’s disease and high cholesterol are conditions that are also boosting the demand for such novel therapies, with new antisense drugs showing great clinical promise in these indications.

However, there is one lesser-known disease for which antisense drugs are looking to have a positive impact.

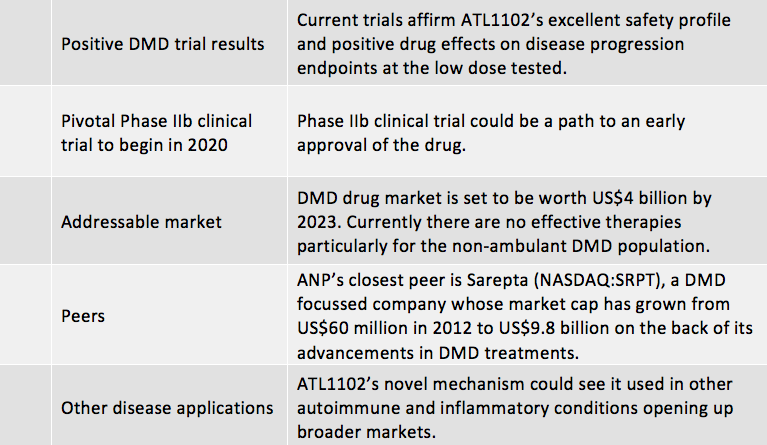

Duchenne Muscular Dystrophy (DMD) is a rare, yet fatal, muscular genetic condition that affects one in 3600 to 6000 male births worldwide.

Sadly, few affected sufferers survive past 30, eventually succumbing to breathing or heart problems.

There is no cure and treatment options are limited, which makes any progress in the field of DMD study extremely important.

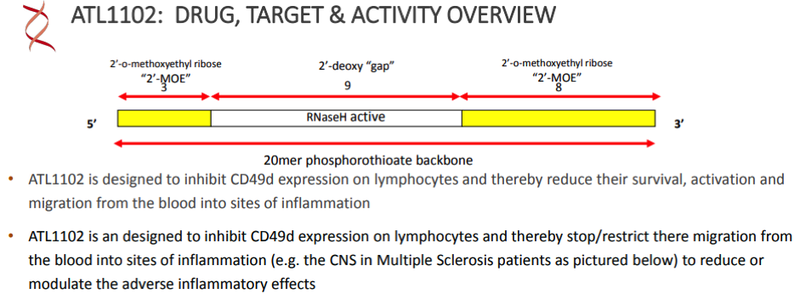

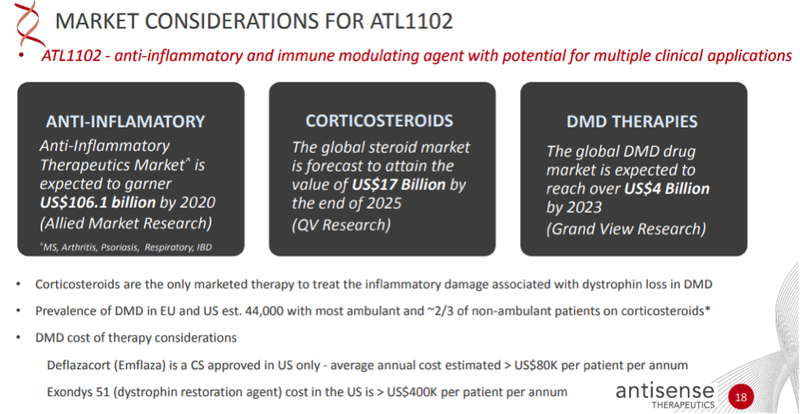

One ASX biotech that is making progress in DMD therapy and hoping to shake up an industry set to be worth US$4 billion by 2023 is Antisense Therapeutics (ASX:ANP).

This week, ANP announced highly encouraging results from a clinical trial being conducted at the Royal Melbourne Children’s Hospital for its ATL1102 drug, used in the treatment of DMD.

After 24 weeks of dosing in all nine patients in the Phase II clinical trial of ATL1102, the study affirmed the drug’s excellent safety profile and positive drug effects on disease progression.

The Phase II trial is in its final stages with the last two patients now in the monitoring phase. The ‘Last Participant Last Visit’ for the study will occur at the start of January 2020, with the final study report to be prepared following trial database lock expected in the first quarter of 2020, so there’s plenty of potential catalysts to come.

On the back of these results, Antisense is looking to advance ATL1102 into a potentially pivotal Phase IIb clinical trial with the goal of providing treatment options to all, not just some (as is the case for recently approved DMD therapies), of the boys with DMD.

Antisense’s share price is up over 270% in the last 12 months and rose from 8.2 cents to an intraday high of 12 cents on this news.

The next 12 months could see even bigger gains, as market awareness of the quality of the results being reported by Antisense grows and as the ATL1102 Phase IIb clinical trial plans successfully advance.

Antisense will be looking to follow in the footsteps of the US$9.8 billion capped Sarepta (NASDAQ:SRPT), whose former chairman is now a non-executive director of Antisense.

Sarepta’s market capitalisation has grown from US$60 million in 2012, when the company began clinical development on their drug Exondys 51 – a treatment for increasing dystrophin levels in boys with the exon 51 mutation.

Exondys 51 eventually gained FDA approval in 2016, with last quarter sales in the US approaching US$100 million.

Yet Sarepta’s treatment is only useful for 13% of boys with the exon 51 mutation, while Antisense’s ATL1102 has a much broader focus as ATL1102 is being developed to treat the inflammation that is caused by the loss of dystrophin, exacerbating tissue damage and causing fibrosis in DMD patients — an aspect of the disease that, at the moment, can only be managed with corticosteroids and effects all DMD patients.

As a consequence of the success of Sarepta and their value creation story, there is growing activity in the DMD drug development space with $2.2 billion in capital raising deals involving DMD pipeline drugs reported in 2017.

This activity is expected to work in Antisense’s favour, by drawing significant investor and big pharma company interest to Antisense and its promising DMD program. Even the Australian government is on board, investing $20million to address the increasingly significant burden of neurological disorders including DMD.

It’s a perfect time to be delivering positive trial outcomes, so with that in mind let’s catch up with ...

Share price: 0.089

Market capitalisation: $38.13

Here’s why I like Antisense:

The DMD market is growing

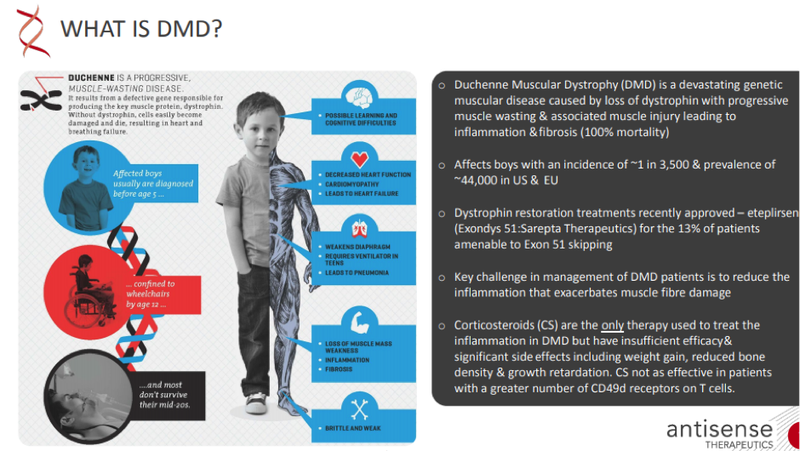

The global (DMD) drugs market size is expected to be worth over US$4 billion by 2023, according to a recent report by Grand View Research, Inc., expanding at a CAGR of 41.3% over those coming three years. This compares to an overall market value of ~US$365 million in 2017.

Several factors such as emergence of mutation-specific therapies, growing target population, and favourable government initiatives are driving the market growth.

DMD is the most common form of muscular dystrophy affecting 16 to 20 infants per 100,000 live births and is caused due to absence or deformity in DMD gene that codes for dystrophin – a key protein for maintaining muscular integrity and strength.

The condition primarily affects males, as it is an X-linked genetic disorder

Here is a look at expected market growth in the market to 2023:

Despite the work being done, there are no local listed companies working in the space, so an investment in a DMD treatment focused company such as Antisense is a very enticing prospect.

Due to Antisense Therapeutics’ (ASX:ANP) recent trial results, the addressable markets it can target and the positive momentum in the space it operates, Antisense is a key stock to consider.

A comprehensive report on how Antisense got to this point can be found in our initial article: ASX Junior’s Flagship Immunomodulatory Drug Could Turn the Tide in Duchenne Muscular Dystrophy Treatment.

The article takes an in-depth look at what DMD is as well as Antisense’s relationship with the US$9 billion-capped Ionis Pharmaceuticals (NASDAQ:IONS), from whom Antisense acquired the ATL1102 drug.

It also discusses the investment by $2.6 billion-capped Platinum Asset Management (ASX:PTM) and Australian Ethical Investment (ASX:AEF), in a $5 million raising with the capital going towards Antisense’s Phase II DMD clinical trial. These highly regarded institutional investors have continued to invest in the company and remain substantial holders with approximately 6% and 16% holdings respectively.

Here is Antisense managing director Mark Diamond explaining DMD and the studies and trials Antisense has undertaken, including the most recent study. Note this was before this week’s results.

Antisense surges on ATL1102 results

Antisense reported promising clinical trial data on Tuesday 17 December, resulting in its share price surging nearly 50% during the day.

Data was reported from all nine participants following the completion of their 24 weeks of dosing in the trial, with results regarded as highly positive.

The Phase II clinical trial of ANP’s immunomodulatory therapy, ATL1102 for DMD affirmed the drug’s excellent safety profile and positive drug effects on disease progression endpoints at the low dose tested.

This in turn has validated the company’s plans to advance ATL1102 into a potentially pivotal Phase IIb clinical trial.

Commenting on the significance of these results, William Goolsbee, non-executive director of ANP, chairman of the ATL1102 for DMD Scientific Advisory Board and former chairman of Sarepta Therapeutics said, “Seeing the efficacy signals of this study, conducted with a low dose in a small number of boys over a relatively short time period, is both gratifying and immensely encouraging.

‘’DMD is a devastating disease where only a small handful of drugs have shown indications of efficacy so early in development.

‘’In the context of DMD, we now look to have a drug, and we have a great task ahead of us as we move ATL1102 into deeper study with the goal of providing treatment options to all, not just some, of the boys with DMD.”

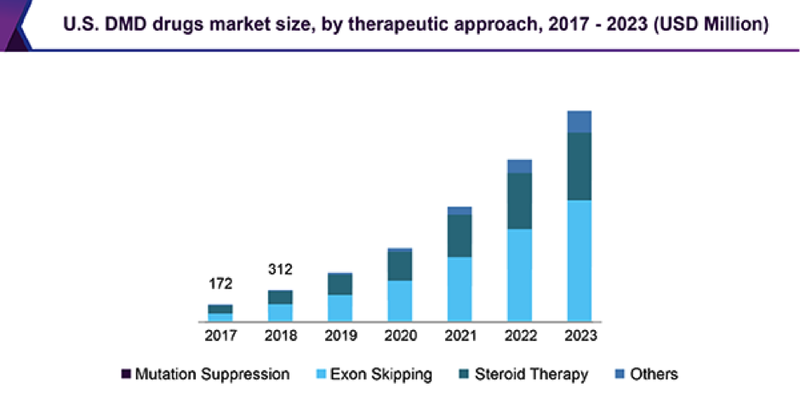

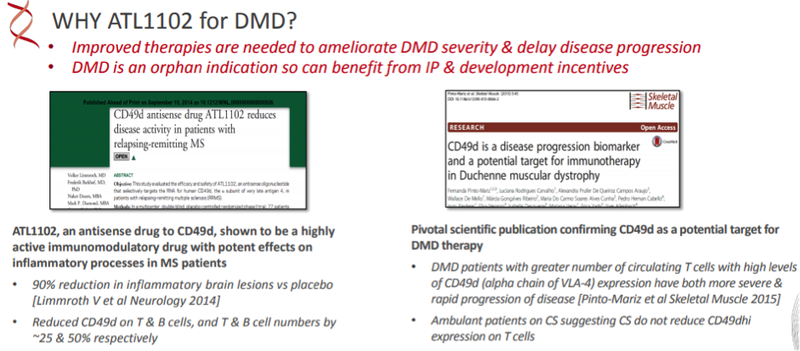

ATL1102 is an antisense inhibitor of CD49d, a sub-unit of VLA-4 (Very Late Antigen-4).

Antisense inhibition of VLA-4 expression has demonstrated activity in a number of animal models of inflammatory disease including asthma and Multiple Sclerosis (MS).

ATL1102 has also successfully completed a Phase II efficacy and safety trial in MS patients, significantly reducing the number of inflammatory brain lesions in patients versus placebo.

Only drug in clinical development targeting CD49d

ATL1102 is an inhibitor of CD49d expression on certain immune cells (e.g. T lymphocytes).

It has been reported (Pinto-Mariz et al 2015) that DMD patients who have a greater number of T cells with high levels of CD49d have more severe and rapid disease progression.

ATL1102 is the only drug in clinical development for DMD targeting CD49d and one of a very limited number of treatments being tested in wheelchair bound DMD boys who are at a more advanced stage of the disease.

The primary objective of the ATL1102 trial is to assess the safety and tolerability of 25mg of ATL1102 administered once weekly (subcutaneous injection) for 24 weeks in non-ambulatory DMD participants.

ATL1102 appeared to be generally safe and well tolerated in non-ambulant boys with DMD. No serious adverse events have been reported and there have been no safety concerns expressed by the Data Safety Monitoring Board.

There were no participant withdrawals from the study, with the most commonly reported adverse events relating to the subcutaneous administration of the drug, mainly injection site erythema and skin discolouration.

Assessing drug activity and efficacy

The trial also assessed drug activity and efficacy, including measuring the effects on immune cells numbers in the blood and measuring the upper limb functional capacity of the wheelchair bound (non ambulant) DMD boys as evaluated via Performance of Upper Limb Test (PUL2.0) and upper limb strength via MyoGrip and MyoPinch assessments.

These are standard tests for assessing disease improvement, stabilisation or progression in non-ambulant DMD patients.

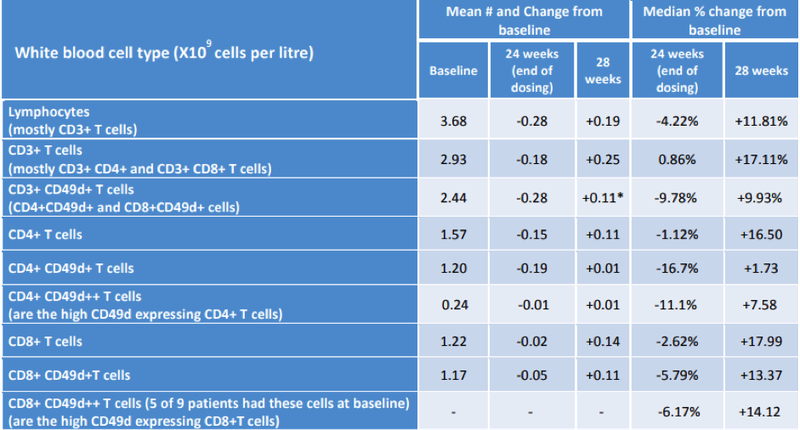

Notably, the immune cell data showed a consistency in the mean reductions in the number of lymphocytes and types of lymphocytes (i.e. CD3, CD4, CD8 and those expressing CD49d) measured from baseline to end of dosing at week 24 with a return to around starting levels post dosing at week 28, consistent with its anticipated immunomodulatory effects.

The following table shows the promising results achieved in immune cell modulation.

The mean number of CD3+CD49d+ T cells (CD4+CD49d and CD8+CD49d+ cells) at week 24 was statistically significantly lower than week 28 (p=0.030 paired T test).

The above data is supportive of the drug’s positive effects on modulating CD49d+ T cells in the blood – CD49d being the target of the ATL1102 drug.

A closer look at this data is available in the company’s announcement to the ASX from 17 December – ‘Positive results reaffirm plans to advance ATL1102 for DMD to Phase IIb trial’.

In commenting on the above observations regarding lymphocyte changes, Dr Pinto-Mariz from the Institute of Pediatrics, Federal University and the Laboratory on Thymus Research, Oswaldo Cruz Foundation, Rio de Janeiro, Brazil said:

“I am pleased to see the ATL1102 drug targeting CD49d in DMD patient trials following on from our work and publications on the importance of the CD49d expressing cells in DMD.

‘’I am very happy that ATL1102 reduced T cells expressing CD49d which should enable the assessment of our hypothesis that the number of T cells expressing high levels of CD49d is a progression and severity marker in non-ambulant DMD patients.”

Notable improvement in muscle strength

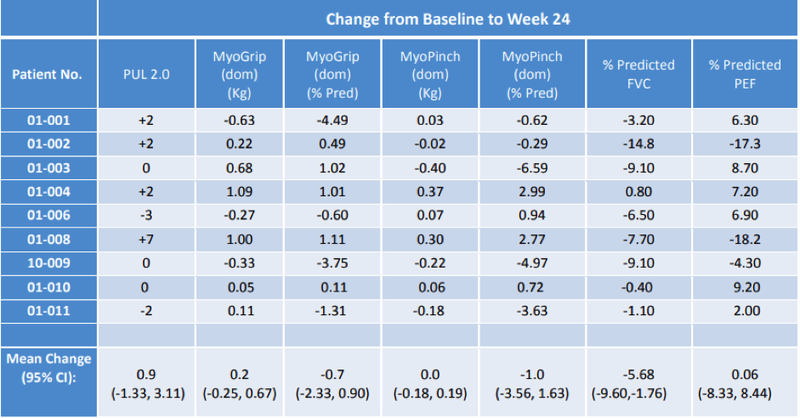

With regard to the endpoints that assess the drug’s effect on muscle function and disease progression, the PUL2.0 data as reported in the following table shows that 7 of the 9 participants demonstrated either increases or no change in their PUL2.0 scores from baseline, suggestive of an overall improvement with a positive mean change of 0.9 in this key parameter.

MyoGrip and MyoPinch assessments using the Myoset system are also recorded in the above table with the data continuing to show a distinct improvement in muscle strength based on the observed mean changes from baseline compared to the loss of muscle strength reported in the Ricotti et al 2016 publication in a similar non-ambulant patient population on corticosteroids.

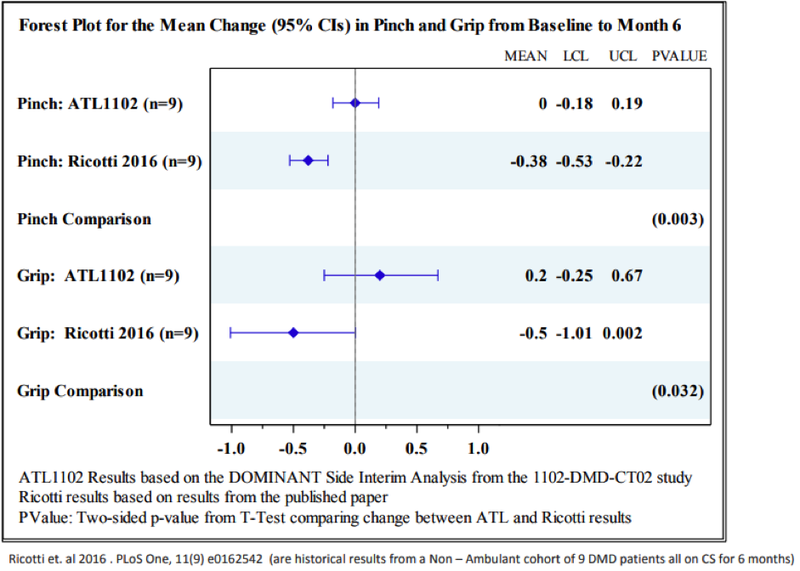

The Forest plot illustrated in the following graph shows the improvements in grip and pinch strength in patients on ATL1102 compared to the loss of muscle strength reported in the Ricotti et al 2016, and this is determined to be statistically significant.

With reference to the well-regarded analysis of the loss of function in non-ambulant patients (most on standard corticosteroid therapy) in publications by Pane et al 2018 and Ricotti et al 2019 and what the authors viewed as a clinically meaningful change on PUL and Myoset measurement parameters, the ATL1102 study appears to show three patients as having improved by a clinically meaningful amount on both PUL and Grip strength.

One further patient had a similar clinical improvement on PUL2.0 alone and a further three stabilised on this parameter.

Improvement in functional scores ‘’almost unheard of’’

Professor Thomas Voit MD, Director, NIHR GOSH Biomedical Research Centre, UK who is an author of the Pinto-Mariz et al 2015 and Ricotti et al 2019 publications was extremely impressed with the trial results and the efficacy being observed in this Phase IIa trial of ATL1102 saying, “Disease stabilisation or indeed improvement in functional scores in non-ambulant DMD boys is almost unheard of and a very encouraging result.

“This is even more meaningful as these results have been obtained using different independent measures and over a relatively short trial time of 24 weeks.

“These results also advise on endpoint choice for a fully powered placebo-controlled registration-enabling study.”

The results continue to be highly supportive of the company’s plans for a Phase IIb clinical trial of ATL1102 in DMD.

Prospect of early regulatory approval

Over recent months Antisense has held scientific advice meetings with three independent European regulatory authorities with the focus of these meetings being on the Phase IIb trial design, dose escalation plans, applicability of the study endpoints and the study duration.

There was general acceptance by the agencies at the meetings on the proposed trial efficacy endpoints (PUL2.0, Myoset), safety-monitoring plan, dosing duration (12 months) and the use of higher doses.

Encouraging clarification was provided by the agencies that this could be a path to an early regulatory approval on positive Phase IIb results.

The next step for the company will be to follow up the development plan with the European Medicines Agency and, subsequent to the finalisation of the results from the current Phase II trial, engage with the Food and Drug Administration on development plans for the US.

Commenting on the significance of these developments and the strategic implications going forward, Mark Diamond, chief executive of Antisense said, “We had high expectations for ATL1102 in DMD, and this first study has certainly exceeded them with respect to its efficacy signal at the lower dose tested.

“The next stage of development will be in translating what we have learned into optimising clinical benefits for the non-ambulatory boys who comprise approximately 50% of the total DMD population, and who have no effective treatment options.

“The company is moving forward with all deliberate speed to advance ATL1102 through the clinic, with specific view to a blinded controlled study in the European Union (EU) which, based upon recent and on-going guidance, may lead directly to early approval.”

What regulatory approval means

Should Antisense achieve early regulatory approval, it could very well follow in the footsteps of Sarepta.

Upon receiving FDA approval of Exondys 51 in 2016, Sarepta’s market cap ballooned from US$60 million in 2012 when they started Exonyds 51 clinical development to a market cap of $3 billion. Today it is approaching US$10 billion.

Exondys 51 (eteplirsen) is specifically indicated for patients who have a confirmed mutation of the dystrophin gene amenable to exon 51 skipping. These patients constitute approximately 13% of the population with DMD. The average cost per patient as previously noted is in excess of US$300,000 per patient per annum.

Interestingly, just this week the FDA approved Sarepta’s Vyondys 53, which is approved to treat the roughly 8% of DMD patients whose disease results from a mutation of the exon 53 gene.

Again, this accelerated approval wasn’t without controversy, but as with Exondys, Sarepta’s shares soared.

Grandview predicts Exon-skipping drugs, like Exondys 51 and the newly approved Vyondys 53, will take 45% of the market by 2023.

ATL1102 has much broader scope which could lead Antisense to target not only a bigger slice of the DMD market, as well as the US$17 billion steroid and the US$106 billion anti-inflammatory market – keeping in mind that ATL1102 may provide a much safer alternative to steroid-based therapies. With its unique mechanism of action, ATL1102 may also be used in combination with existing DMD treatments on the market (such as Exondys 51) and those therapies presently in clinical development.

The final word

The DMD drugs market is projected to grow dramatically in the coming years, with pipeline products set to impact the DMD therapeutic landscape.

Antisense hopes to be at the forefront of this change with its truly novel treatment and is initially targeting a population in non-ambulant patients who today have no effective treatment option.

Antisense will benefit from a number of key initiatives and movements in this space.

Through its landmark Medical Research Future Fund, the Morrison Government is investing $55 million to research rare cancers and diseases, including DMD.

Meanwhile, Sarepta has continued to make large gains in its capital value on the back of development progress with its DMD focused pipeline drawing much attention from healthcare investors. Antisense expects to ride high on this global wave of investor interest.

Recent results for Antisense could put it on a similar path and with a potentially pivotal Phase IIb clinical trial to commence in 2020, there will be many catalysts to push its market cap further north.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.