North American cannabis scandals rock share prices

Published 26-JUL-2019 10:58 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

North American cannabis stocks have been rocked by scandal lately.

Regulatory deadlocks, smaller than expected returns, illegal growing and weaker than expected earnings is having a major effect on share prices.

One of the biggest shocks to the market came with the axing of the man considered to be the face of legal cannabis in North America.

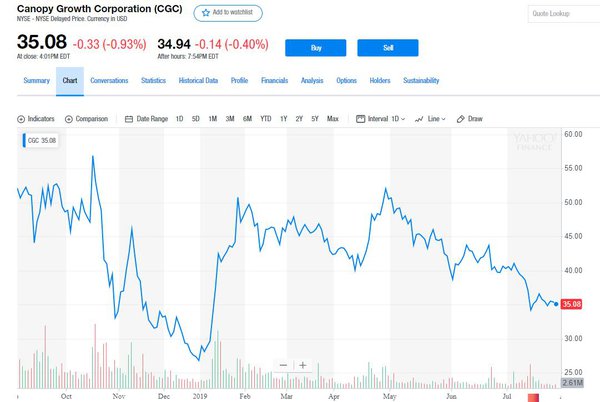

Bruce Linton was fired as the co-CEO of Canopy Growth after a disappointing financial performance in Q1 2019.

The sacking rattled the industry, however Linton quipped in his keynote address at the National Cannabis Industry Association’s Cannabis Business Summit: “I can confirm there is no such thing as job security, no matter what you do”.

Linton had some sage advice for cannabis companies in his speech, proving he’s not bitter about his parting of ways. He said marijuana companies should look to locate in economically distressed towns or areas that are looking for injections of capital and jobs that cannabis businesses can bring with them. He believes alcohol giant Constellation Brands and others will be able to turn around stock prices that may have dipped in recent months. European marijuana markets will accelerate rapidly due to socialized medical programs in place that will help establish medical marijuana programs. The US needs to reform federal marijuana laws quickly, before the US falls behind global exporters.

Interestingly, Constellation Brands has effectively taken control of Canopy.

This article by Yahoo Finance suggests, Constellation may not have the knowhow to successfully replace Linton.

The article also states that a drop on Canopy’s price may not be a bad thing for the market.

“The good news to me is Canopy Growth isn't likely to recover from the hyped-up expectations surrounding it, and that means expectations for the company and industry will lowered to more realistic levels, and after the bearish sentiment dissipates, there should be a nice rebound for Canopy and the industry in general; although I think isn't likely to enjoy the change in sentiment as much as its competitors will, primarily because of the decision to release Linton of his duties.”

Over at CannTrust Holdings Corp, shares slumped more than 20% on the TSX to $2.70 from $3.43 after reports that chairman Eric Paul and its chief executive Peter Aceto knew that the firm was growing pot in unlicensed rooms at its Ontario greenhouse.

The company is now being investigated by Health Canada after it discovered CannTrust was growing cannabis before it was licenced to do so.

Nearly 13,000 kilograms of cannabis products have been put on hold, with CannTrust voluntarily halting all shipments and sales of its products until the investigation is complete.

Curleaf is the third North American company to make the news recently, following a warning by the Food and Drug Administration that it considered Curleaf’s lotion, pain-relief patch, tincture and disposable vape pen to be drugs because they claim to treat conditions like pain, anxiety and ADHD.

This news caused the share price to plunge 14%.

The company has 14 days to respond.

“Selling unapproved products with unsubstantiated therapeutic claims - such as claims that CBD products can treat serious diseases and conditions - can put patients and consumers at risk by leading them to put off important medical care,” acting FDA Commissioner Ned Sharpless said this week.

“There are still “many unanswered questions about the science, safety, effectiveness and quality of unapproved products containing CBD.”

As the US suffers, there’s one Australian stock worthy of a watchlist

On Wednesday 25 July, Althea emerged from a trading halt that saw its shares rise by 12%.

The announcement that piqued investor interest related to the acquisition of Canadian extraction and contract manufacturing company Peak Processing Solutions.

Peak was founded by four former senior personnel from cannabis giant Aphria Inc.

Althea expects Peak to become a leading contract manufacturer for consumer brands looking to launch recreational cannabis and cannabidiol (CBD) wellness products.

The cash component of the consideration to be paid by Althea will be funded via a A$30 million placement, which will be conducted at A$1.00 per new share, which represents a 16% discount to the last close price.

Althea Chief Executive Officer Josh Fegan said: “We are very pleased to have entered into this agreement to acquire Peak Processing Solutions, including their team of tremendously experienced cannabis operators. We see huge potential in the cannabis-infused segment and on top of delivering great value to our shareholders, Peak provides Althea access to innovative technologies and cannabis delivery systems which we can utilise to enhance our range of medicinal cannabis product offerings.”

And MGC also continues its upward trajectory

This week, MGC Phamaceuticals (ASX:MXC) was up as much as 15% before correcting at 7.5% to close at 5.7 cents on Wednesday.

MXC’s pre-clinical research has highlighted the positive impact of using specific cannabinoid formulations in the treatment of glioblastoma, the most aggressive and therapeutically resistant primary brain tumour.

The research, conducted in collaboration with the National Institute of Biology and University Medical Centre Ljubljana, is seen as a major scientific breakthrough in respect to successfully applying cannabinoid compounds on cancerous cells.

Co-founder and managing director, Roby Zomer said: “This research is a major breakthrough for the treatment of tumours with cannabinoid-based formulations and has wider implications on different cancer treatments. The full research report successfully shows that compounded cannabinoid formulations can have a positive effect on the treatment of glioblastoma, reducing the growth of a tumour cell and killing the cancerous stem cells. We are now creating a cannabinoid compound matrix which we can utilise to target a wider range of cancers and significantly advance our R&D capabilities.”

Zomer believes this breakthrough could be a game changer for the company.

Time will tell whether that is true or not, but it seems Australian stocks are having a better time of it than their North American cannabis counterparts.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.